GoHenry is the UK’s number one debit card for kids, with more than two million members learning about money management in an easy and digestible way. The GoHenry youth debit card works just like a normal kids’ bank account, but with lots of extra benefits that give them independence and you peace of mind. Not only can kids and teens gain financial independence, but they’ll learn along the way with an educational mobile app to teach your kids invaluable skills about money. Be money-savvy yourself with our GoHenry vouchers and cashback deals to get money back when you sign up.

GoHenry UK gives young people aged 6–18 the tools they need to grasp the basics of budgeting, earning, saving, spending, and more. Whether you’re looking for flexible control, weekly allowances, or secure safety features, the clever money app has it all. For a monthly fee of just £3.99 per child, you’ll get access to a customisable debit card, app download, and educational tools to make both your lives easier.

We’ve found lots of handy GoHenry offers to save money on your account, too. Sign up as a new customer and you’ll get a 30-day free trial to see if it’s a good fit for your family. If you’re a member of our site (it’s free to join), you can find a GoHenry discount code to get up to three months free, plus you’ll earn cashback deals on top with an extra click. Opt in to their email newsletter to receive exclusive discounts straight to your inbox and refer a friend to get £30 to your parent account.

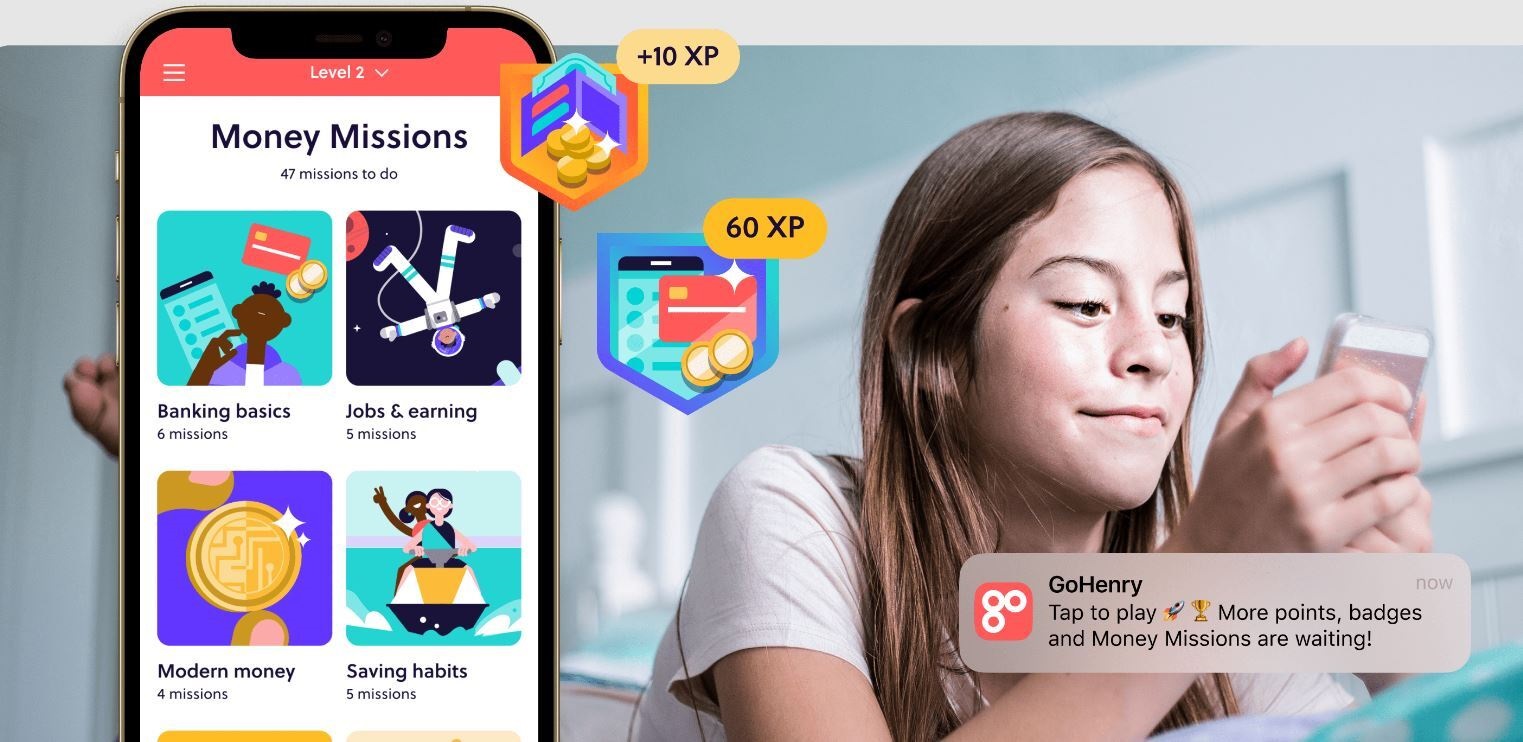

Money Missions in the GoHenry app

Money management for kids & teens

When you sign up for a GoHenry card, you’ll be able to choose from more than 45 custom designs, with your child’s name added for personalisation. Not only is there an app for kids but also a companion app for parents for flexible control over children’s spending, easy transfers, and weekly allowances. The GoHenry app is more than just a handy way to keep an eye on credits and debits. In-app videos and quizzes called Money Missions make budgeting fun, so your child can learn about money and earn points and badges.

GoHenry works just like a top-up card, so your kid can add and spend money without any worries of overspending or debt. You can even set spending limits on cash withdrawals and get instant notifications on where and when the card is used, all while they gain financial freedom. The cards for teens mean they have extra benefits like receiving wages via BACS payment and sending or requesting money to and from friends.

Strict security features mean that you don’t need to worry about unsafe spending or theft. GoHenry will automatically block risky transactions, plus with fingerprint and facial recognition, chip and PIN-protected transactions, and bank-level encryption, there are plenty of safety measures in place. Lost card? Parents can easily block and unblock it from the companion app.

ENTER

ENTER