The information in this article has been sourced from information available in the public domain. You should take independent financial advice before entering into a mortgage or other investment product.

Knowing how much money you need to get together for your deposit is one of the first and most important steps of the house-buying process.

This guide explains in simple terms how mortgage deposits work and how to figure out how much deposit you need to save for your property purchase.

We’ll also cover the benefits of saving a higher deposit, which include better interest rates and lower monthly repayments.

Quick answer: How much deposit do I need for a house?

The quick answer is that the minimum deposit required is 5% of the property price. However, this will depend on your individual circumstances. Most buyers are required to put down 10% or more.

What is a house deposit?

A house deposit is a lump sum of money you pay upfront when you buy a property. It could be anything from 5% of the property value, but most people buying their first home pay between 10% and 20%.

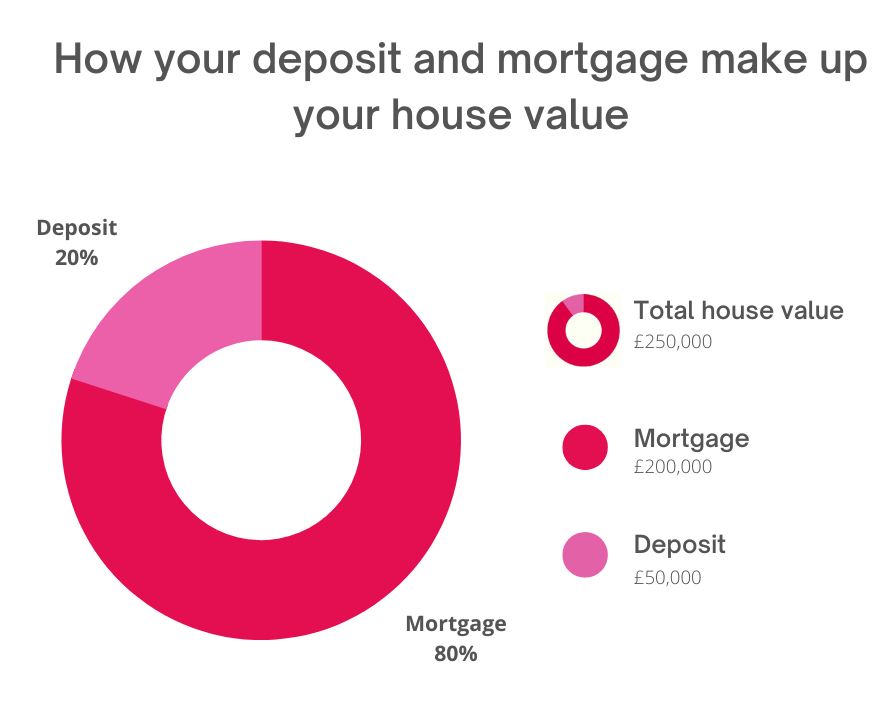

The remaining house value after your deposit is deducted is the amount you'll be looking to borrow as a loan from a lender (a bank or building society). This loan is your mortgage.

If you're buying a house for £250,000 and your lender is willing to lend you 80% of the total purchase price, you'll have a £200,000 mortgage and will need to pay a £50,000 deposit upfront:

If a lender is happy to lend you 90% of the property price, that’s a £225,000 mortgage with a £25,000 deposit:

How to work out how much deposit you need

Working out your deposit can be a bit of a balancing act. Here are the two main questions you need to answer in order to work out how much deposit you need to save.

Question 1: What’s the average house price in your desired area?

The area where you’re looking to buy your home will have a big sway on the price. The average UK house price in January 2025 was £268,548, although London is (unsurprisingly) considerably higher, with the average being £563,899.

The table below shows the average house prices in different parts of the UK in January 2025:

Location | Average price |

|---|---|

London | £563,899 |

England | £291,397 |

Wales | £209,579 |

Scotland | £187,434 |

Northern Ireland | £183,259 |

These figures are overall averages and don’t take into account property type and size. Make sure you’re looking at the types of properties you want to buy when working out your budget.

Question 2: How much money can I borrow?

Your household income will impact how much you can borrow for your mortgage.

To get a quick idea of how much you can borrow, take a look at a mortgage affordability calculator online (such as this one from Money Helper).

Generally speaking, a mortgage lender is likely to consider lending you between four and four-and-a-half times your annual salary (or combined salaries). The table below shows an example of how this might play out:

Number of people | Total salary | 4 x total salary | 4.5 x total salary |

|---|---|---|---|

1 x £30,000 salary (1 buyer) | £30,000 | £120,000 | £135,000 |

2 x £30,000 salary | £60,000 | £240,000 | £270,000 |

One buyer

1 x £30,000 salary (1 buyer) =

£30,000

4 x times £30,000 salary =

£120,000

4.5 times total salary =

£135,000

Two buyers

2 x £30,000 salaries (two buyers) =

£60,000

4 times x £60,000 total salary =

£240,000

4.5 times x £60,000 total salary =

£270,000

Weighing up the answers to those two questions…

How does your potential mortgage affordability look against the average house prices in the area you’re looking to buy? Are you left with a reasonable deposit amount to aim for, or is this out of the question?

If the difference in price between your mortgage affordability and the total price of the property is between 5% and 20%, this is likely a sensible house budget. This would mean borrowing between 80% and 95% of the total purchase price, and paying the remaining 5%–20% value upfront.

This figure is known as a loan-to-value (LTV) ratio, and it represents the value of your existing loan as a percentage of the total value of the property you're buying.

Let’s look at this in action. The average price of a semi-detached home in Manchester in November 2024 was £317,435. If your mortgage affordability is around £280,000–£285,000, you’d need to save up a deposit of around £32,435–£37,435.

We know there’s a big difference between £32,435 and £38,735 – an independent mortgage broker will be able to give you a clearer idea of your affordability.

A mortgage broker can offer you free financial advice based on your individual financial situation. They’ll take into consideration your credit history and existing debts, which means they can give you a far more accurate mortgage estimation than an online tool can.

The benefits of saving a bigger mortgage deposit

While you might be able to put down a deposit of as little as 5% of the property price, there are a few important reasons why it's worth pushing to increase your deposit if you can.

1. Lower loan-to-value ratios (LTV)

The more money you can put into your deposit, the less you’ll be borrowing. As a result, you’ll own a larger portion of the property from the outset. This is known as your loan-to-value (LTV) ratio.

However, the situation is often different for people buying their first home, who might have less money saved up (and no equity in existing property).

If you're a first-time buyer, a low-deposit mortgage like a 95% mortgage may be a realistic option for you (although these do come with relatively high interest rates).

2. Shorter mortgage terms

If you're able to put down a bigger deposit and reduce your LTV ratio, your mortgage loan will be smaller.

This means you may be able to shorten the length of your mortgage term (the number of years your mortgage will be spread out over).

The quicker you pay your mortgage off, the less interest you'll pay over the years. This could save you thousands of pounds.

3. Better interest rates

Borrowing less and having a lower LTV ratio means you may benefit from a more favourable interest rate.

The less you’re borrowing from a lender, the less risk you pose to them (because if you default on your loan, they’re losing less money if you borrowed less).

With a lower mortgage interest rate comes lower monthly payments and less money spent over the years of your mortgage term.

Remember that your deposit and mortgage are only part of the big picture when it comes to buying a house. You’ll also need to make sure you’ve got enough money set aside to pay for other costs, including stamp duty, solicitor fees, and house surveys.

How to increase your house deposit

Building a larger deposit can benefit you in a multitude of ways. Not only are you limiting your own financial risk by borrowing less money, but you can also benefit from shorter mortgage terms and better interest rates.

Here are a few of the best ways to increase your house deposit.

Optimise your savings using the best savings accounts

If you have a little while to save up before purchasing a house, you might want to consider opening a dedicated savings account.

While you could keep your money in your current account or a standard easy-access savings account, this doesn’t necessarily mean you’re optimising your savings in the best way.

Cash ISAs (Individual Savings Accounts) can be a great way to maximise your savings. These differ from regular savings accounts because you don’t pay tax on any of the interest your savings earn.

Lifetime ISAs

Lifetime ISAs (LISAs) are designed to help new home buyers build up their first-time buyer deposit and get on the property ladder.

LISAs have replaced Help-to-Buy ISAs. With a Help-to-Buy ISA, you can pay up to £200 into your account per month and receive a 25% bonus on your savings.

You can no longer open a Help-to-Buy ISA but if you already have one, you can continue adding to your savings until 30th November 2029.

You can get a 25% government bonus on your savings when you open a LISA and use your savings for your house deposit, as long as you’re between the ages of 18 and 40 and have never bought a property before.

You can put up to £4,000 into your LISA every tax year, which means you can earn a government bonus of up to £1,000 per tax year.

If you’re considering opening a LISA, there are a few things to bear in mind…

There are penalties for those who withdraw their savings for something other than their first home or retirement. You'll also have to pay this penalty if you cash out your LISA within a year of opening your account.

This makes it very important to only put money you’re planning to use to buy a house into your LISA. If you don’t, you’ll lose your 25% bonus and also a fraction of your own initial savings.

So, if you’ve put the maximum payment for the year, £4,000, into your LISA…

£4,000 + 25% government bonus (£1,000) = £5,000

£5,000 - 25% penalty (£1,250) = £3,750

This means you’ll lose £250 of your original savings, ending up with only £3,750 of your original £4,000.

While the average house price remains considerably below £450,000 in most areas of the UK, first-time buyers in London will need to bear the £450,000 property purchase price limit in mind.

If you have a Help-to-Buy ISA, the house price limit is much lower at £250,000 (or £450,000 for properties in London).

If you’re buying your first home with a partner, family member or friend, you’ll both need to be first-time buyers in order to benefit from the LISA scheme. If one of you isn’t a first-time buyer, you won’t qualify for your 25% cash bonus.

ISAs aren’t the best option for everyone. Make sure you do your own independent research to find the best type of ISA or savings account for you. Speak to an advisor or your bank.

Reduce your spending

If you’re able to cut down on any of your monthly spending, this can help you boost your deposit. Why not see if you can find some wiggle room in any of the following areas?

Reduce your utility bills and subscriptions

Reduce your utility bills and subscriptions

You might be able to find a few places where you can cut back your monthly spending.

Have a look over your subscriptions and regular payments to see if you’re paying for anything you don’t use. Is it time to switch broadband provider or can you find ways to reduce the cost of your weekly food shop?

Put a budget in place

Put a budget in place

Whether you’re saving short-term or long-term, getting yourself into some healthy budgeting habits can be a great way to move toward your savings goal. We’ve got a beginner’s budgeting guide that’s packed with ideas to help you get started.

Increase your income

Ever wondered if you could turn a hobby into a cash cow? There are quick and easy ways to make a bit of money without even having to leave your house.

Take up a side hustle

Take up a side hustle

Whether it’s pet-sitting or online surveys, you can make a quick buck when you monetise a hobby or take up a new side gig. Read our side hustles guide to get some inspo – some of the ideas on that list might surprise you.

Have a clear-out

Have a clear-out

Why not go through your wardrobe and see if you’ve got any clothing that could be worth a bit of cash? Other things in your home that might be worth a pretty penny include old phones and unwanted books.

Getting started

Buying a house is a complicated and often very stressful process. But the more clued up you are on how the process works, the better prepared you’ll be for any unexpected obstacles.

Make use of the free resources available to you when it comes to mortgage advice, both online and in person. Speak to a trustworthy financial adviser or broker and ask any other family members or friends who’ve bought a home in the past.

It’s also important to remember that there are other costs associated with buying a house that you need to be prepared for. You’ll need to set aside money to cover stamp duty, your house survey or snagging survey, and your solicitor fees.

If you need any advice about managing your money, Shelter, National Debtline and StepChange all offer free help. You could also use a free budget planner (such as the government’s Money Helper budget planner) to help keep track of your monthly spending.

The information in this article has been sourced from information available in the public domain. You should take independent financial advice before entering into a mortgage or other investment product.