Taking control of your finances in life can be stressful, and if you have no idea how to budget, getting started can be a daunting prospect.

Money management might seem like a difficult prospect if you’ve never tried it before, but there are simple tips and techniques to get you started.

The great thing about budgeting is that there’s no one way to do it. Our beginners guide to budgeting has the best tips, techniques, and tools so you can get started.

The information contained within this article is for editorial purposes only and is a general guide and description of the products listed above. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.

It's really simple: our site takes just 30 seconds when you buy online.

You do the shopping, we'll track your purchase, and then you'll get cashback in your account to withdraw to your bank or as a gift card.

Here's how to get your £15 offer;

- Click: Click the green button

- Join: Create an account

- Shop: Browse brands on our site

- Buy: Click Get Cashback then make a purchase

- Enjoy: We'll add £15 to your account once we track your purchase

How does TopCashback benefit? We make money when you buy from supported brands, which allows us to offer cashback with no hidden fees.

What is a budget (and why should you have one)?

Budget planning might seem like an overwhelming concept, but it’s simply a way for you to keep track of your finances. A monthly budget can help you organise your incomings and outgoings so you know what payments are occurring and when. This can help you spend within your means, enjoy your disposable income, and stress less about money.

With a successful budget, you’ll be able to prioritise where your money goes so you can be prepared for those one-off events like Christmas, birthdays, and holidays. You’ll also be less likely to accrue debt, keep a good credit rating, and be more attractive for loans and mortgages.

So if you find it challenging to keep track of where your money goes or you’re spending more money than you earn, a budget can help you with money management.

What’s your goal?

Identifying your goal for starting a budget is a good first step. Once you know what you aim to achieve, with realistic goals, you can figure out the best type of money management plan for you.

Some of the most common reasons for starting a budget are:

- Clearing debt

- Saving money

- Reducing stress about finances

- Learning about money management

- Spending within your means

Money management isn’t always taught in school, so maybe you just want to educate yourself on different techniques and everyday habits. It’s also helpful to observe what you spend your money on, particularly if you have a penchant for online shopping or a tendency to spend a little too much on takeaways.

How to get started

Begin by writing down tangible figures so you can see what’s what. Gather any physical bills and payslips so you know exactly what is coming in and going out every month.

If most or all of these are digital, write them down somewhere so you can see everything together. Use a pen and paper, a note app on your phone, a spreadsheet, or whatever you prefer. You can always set up a spreadsheet later, this is just the first step.

Incomings

Note down your monthly take-home earnings. If you’re self-employed or your earnings fluctuate each month, use the last six months for an average. Minus tax, National Insurance, and any pension or student loan payments.

Essential & fixed outgoings

These are your most important payments: rent, mortgage, council tax, water, energy, broadband, car, and phone payments.

Non-fixed essential outgoings

Other essential payments like credit card payments, petrol and transport, insurance, and food shopping. Gather the last few months for a rough average.

Nice-to-have outgoings

Additional direct debits like streaming services, gym memberships, and other entertainment subscriptions.

Tips for money management

Start small with these easy and handy budgeting tips for beginners to see what you can start to reduce now that you have concrete numbers to work with. Many of these are recommended by our very own staff members.

Do a direct debit audit

Do a direct debit audit

If you have a lot of subscriptions to entertainment services, see what you could feasibly do without. Do you need three different streaming platforms or can you manage with one? Is there a cheaper option elsewhere?

Evaluate other bills like broadband, credit card payments, and even mortgage payments. You can shop around for other contracts, switch to a cheaper one, or call the company and negotiate.

TopCashback staff member James said that after being a customer of Co-op for about eight years he called to ask for a lower credit rate: “they dropped my credit interest rate by almost half, just for asking.”

Evaluate your food shops

Evaluate your food shops

You may also be surprised by how much you spend every month on food. It might be overpspending on your weekly food shop or going to the pricey corner shop too often.

The places you choose to buy your food can make a difference. Supermarkets like Aldi and Lidl can be great choices for the main bulk of your food shop, even if you need to pick up the last few items elsewhere.

The average person in the UK spends around £31 a week on food shopping. This figure factors in people across all UK regions and pay brackets. So, for example, if you live in the north, eat a vegetarian diet, and shop at Aldi, you should be aiming to spend less than this.

Take a look at what you spend on meals out and takeaways, too. You don’t have to eliminate these activities, but starting by reducing your ‘nice-to-haves’ is a good first step.

Get an idea of what you spend on food every month by using bank statements from the previous few months. If you have online banking, payments are often categorised into types of purchase which makes it easier to find.

Factor in one-off purchases

Factor in one-off purchases

Having a super strict budget with no wiggle room isn’t ideal as you’ll always find occasions crop up that you need to allocate extra money for. These can be Christmas, birthdays, hen and stag dos, and holidays.

You can set aside enough money every month for special occasions so if one creeps up on you, you’re prepared. Sometimes, online banking apps will have built-in features to help you do this, like round-ups. This means if you spend £4.49 at the corner shop, your bank will round up to £5 and add the 51p to an allocated account you can put towards special occasions. It will do this with every purchase you make, which can add up over time.

Beccy at TopCashback said: “I use Monzo and their round-up option throughout the year to budget for Christmas. By the end of the year, I have just over £100 to spend on Christmas presents.”

Switch bank accounts

Switch bank accounts

Save your hard-earned money by finding a bank with the best interest rate. Take a look at what other banks and their savings accounts offer in terms of interest rates, and take advantage of switching bonuses. You can get up to £200 just by switching banks, and earn a higher interest rate on your savings as well.

Buy second-hand

Buy second-hand

Save your pennies and the planet by opting for pre-loved items. This can be everything from fashion to furniture, and you may be surprised at the gems you find. Seek out local car boot sales, shop at charity shops in your area, or use platforms like Gumtree, Facebook Marketplace, Vinted, and eBay.

Buying second-hand can be significantly cheaper than buying new, so you can enjoy your disposable income on a budget. You won’t have the same consumer rights or returns policies, so be sure about an item before you purchase it. Things like expensive electronics might be better bought new if you want a warranty.

We have an entire second-hand shopping guide to help you get started.

Get cashback for online purchases

Get cashback for online purchases

Budget planning is also about shopping smart, so if you do need to buy new, earn money back where you can. We feature 6,000+ brands on our site and you can earn chunks of money on large purchases or contracts. Once you get into the habit of shopping through our site for online purchases, you’ll find you accrue money without even thinking about it.

Save money at 5,000+ top-named brands

Use cash for everyday spending

Use cash for everyday spending

If you simply tap your card every time you buy something, it’s easy to get carried away. Having a fixed amount of physical cash in your wallet per week or per month can help you track your spending.

Check your weekly spending

Check your weekly spending

If you prefer card over cash, you can still keep an eye on what you buy. Online banking makes it easier than ever to quickly check your bank balance. Take five or ten minutes every week to look over what you’ve bought and assess your habits.

Alex at TopCashback said: “I write down personal buys and look at them at the end of the week to see if they were necessary or not. So if I buy a coffee somewhere I think ‘Did I really need a coffee?’ Probably not.”

Budget planning techniques

There are lots of different techniques for starting a budget, many of which can get quite complicated, so we’ve narrowed it down to three. We’ve found these to be the most common and popular among our staff, as well as being quite straightforward to try out.

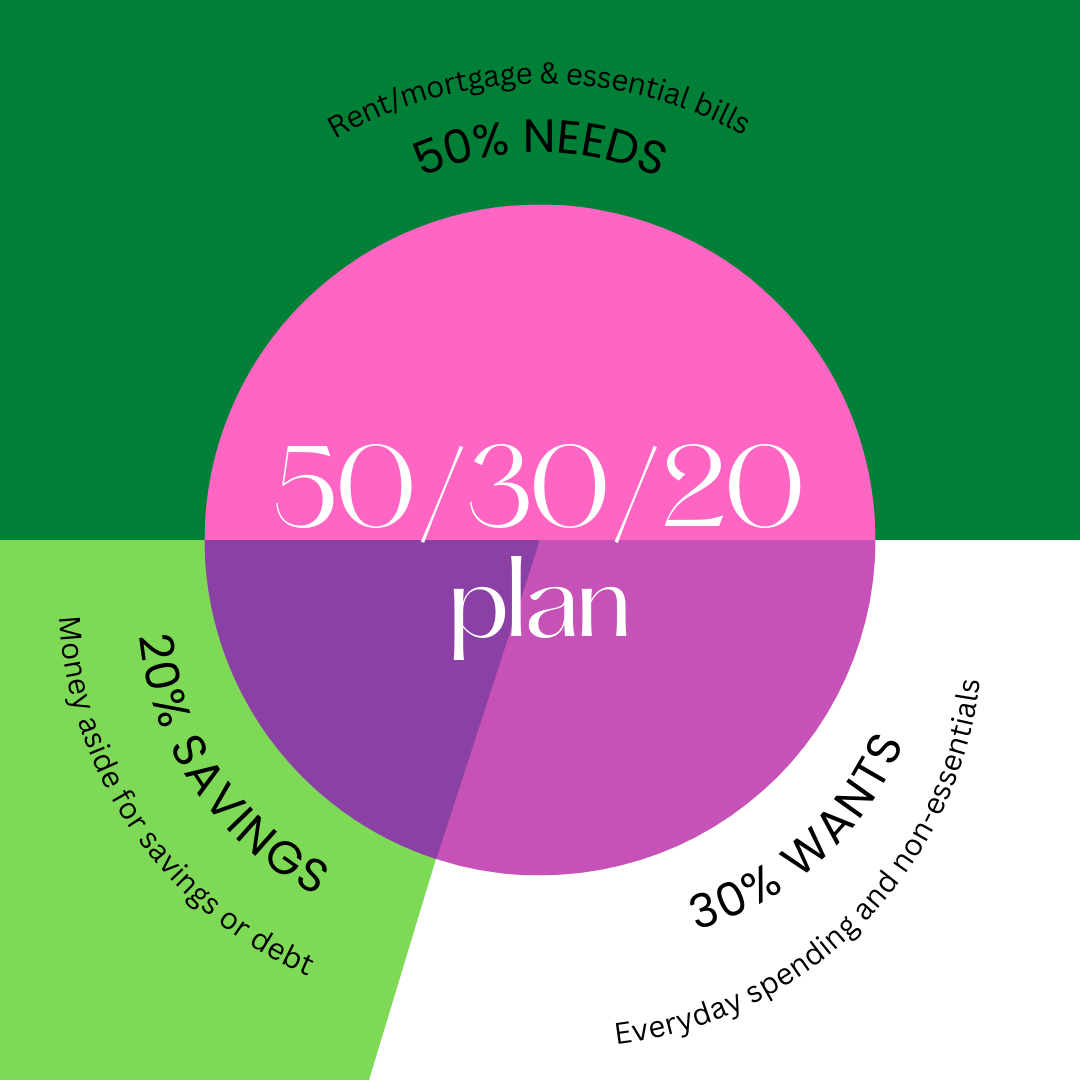

50/30/20 plan

This technique can be a great jumping-off point if you’re new to using a budgeting method. Using the 50/30/20 framework, you simply divide your monthly income into these three portions:

You can adjust the ratios accordingly – your essential bills may come to more than 50% of your monthly income, for example. In this case, you’d probably want to reduce what you spend on non-essentials, rather than cutting into your savings.

Each budget plan is personal, so customise it until you have something you’re happy with. As soon as you get paid, you can use this basic calculation to figure out how much you can spend on each category.

The benefit of this technique is its simplicity and flexibility, meaning it’s great for beginners. If you find you want something a little stricter to reach your financial goals quicker, it can still be useful as a starting point or something you come back to.

Tip: If any of your 20% is going into a savings account, make sure it’s going into an account that earns good interest.

Piggy-banking technique

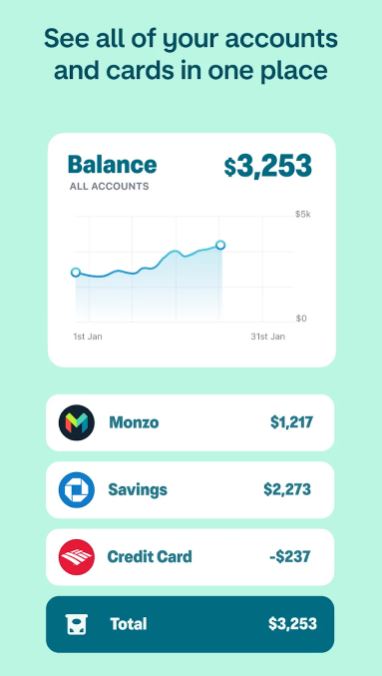

This has been a popular budgeting technique for a while, but now there are banks that make it much easier to do. Using separate ‘piggybanks’ within your bank accounts, you can split up your income into sections for spending.

Instead of creating each piggybank using separate accounts, banks like Monzo, Starling, and Chase allow you to create ‘pots’, 'spaces’, or ‘jars’ under the same account.

Decide on how many piggybanks you want to create based on the major categories of spending like rent & bills, food, special occasions, your savings goals, and everyday living expenses. With Monzo, you can actually name each of your pots.

Once you’ve created your categories, you can set up the piggybanks and pay into them via standing orders so everything is allocated automatically.

The great thing about this budgeting technique is that once you’ve put in the work upfront, everything else is done for you each month. You can always review your categories or tweak the amounts if you need a little more wiggle room.

Hannah at TopCashback uses Monzo’s pots for separating her income: “If I know I have a big social event like a wedding or birthday I may set aside a specific amount. I pay all my bills through one account so I can keep track of it. I note if something has increased like energy so I can add extra cash if needed.”

Pay-yourself-first

We found this technique to be the most common among our staff members – even if they didn’t know there was a name for it.

With the pay-yourself-first budget plan, you put a fixed amount or percentage of your earnings towards your goal each payday. This could be for savings, a retirement fund, investing, or whatever you want. Do this as soon as you get paid and the idea is you don’t touch this money.

There are banks like Starling Bank that allow you to lock away savings in a high-interest account that you can’t access once you’ve made the deposit.

If saving is your goal, you should aim to save around 20% of your income, so if your after-tax earnings are £1500, you’ll be aiming to save £300 every month. Of course, each budget is personal, so customise this to whatever works for you.

Once you’ve put aside your savings, you then focus on paying your essential bills. It’s a good idea to set these up to come out right after payday or on the 1st of the month. After your bills have come out, what’s left is disposable income to last you until the next payday.

Natasha at TopCashback said: “I purposely set up almost all my direct debits to come out on the 1st of the month so I know any money left I have for the next few weeks is my own.”

If you want a bit more structure to your remaining spending money, you can give yourself a weekly allowance. TopCashback staff member Hannah does this: “anything I have left over I then divide by the weeks until next payday and give myself a weekly wage.”

Free budget planners & apps

Need more guidance? There are plenty of budgeting apps, tools, and planners to help you stick to your financial goals. We think it’s a little counterintuitive to pay for a budget planner, so we’ve listed a few of the best free budgeting apps and planners for beginners.

Revolut

Revolut is a popular banking app that makes it easier than ever to keep an eye on what you’re spending and what you’re saving. Even with the free version, you can enjoy all the benefits of these features:

- Revolut Pockets: this feature means you can use the Piggy-banking technique to keep your spending categories separate. You can nominate a pocket for utilities and have your direct debits and standing orders taken straight from here.

- Open banking: link your other bank accounts to your Revolut app and see everything all from one app.

- Scheduled payments: group together your subscriptions for things like Netflix and Spotify so you can track your spending on similar activities. You’ll also be able to cancel or block subscriptions with a few simple taps, cancel free trials, and get reminders for upcoming payments.

- Budgeting & analytics features: set limits on your spending, get weekly insights, and smart analytics that breaks down your spending by categories, merchants, and countries.

- Revolut Rewards: get cashback when you shop at particular places, with some offers giving you as much as 30% back on what you spend.

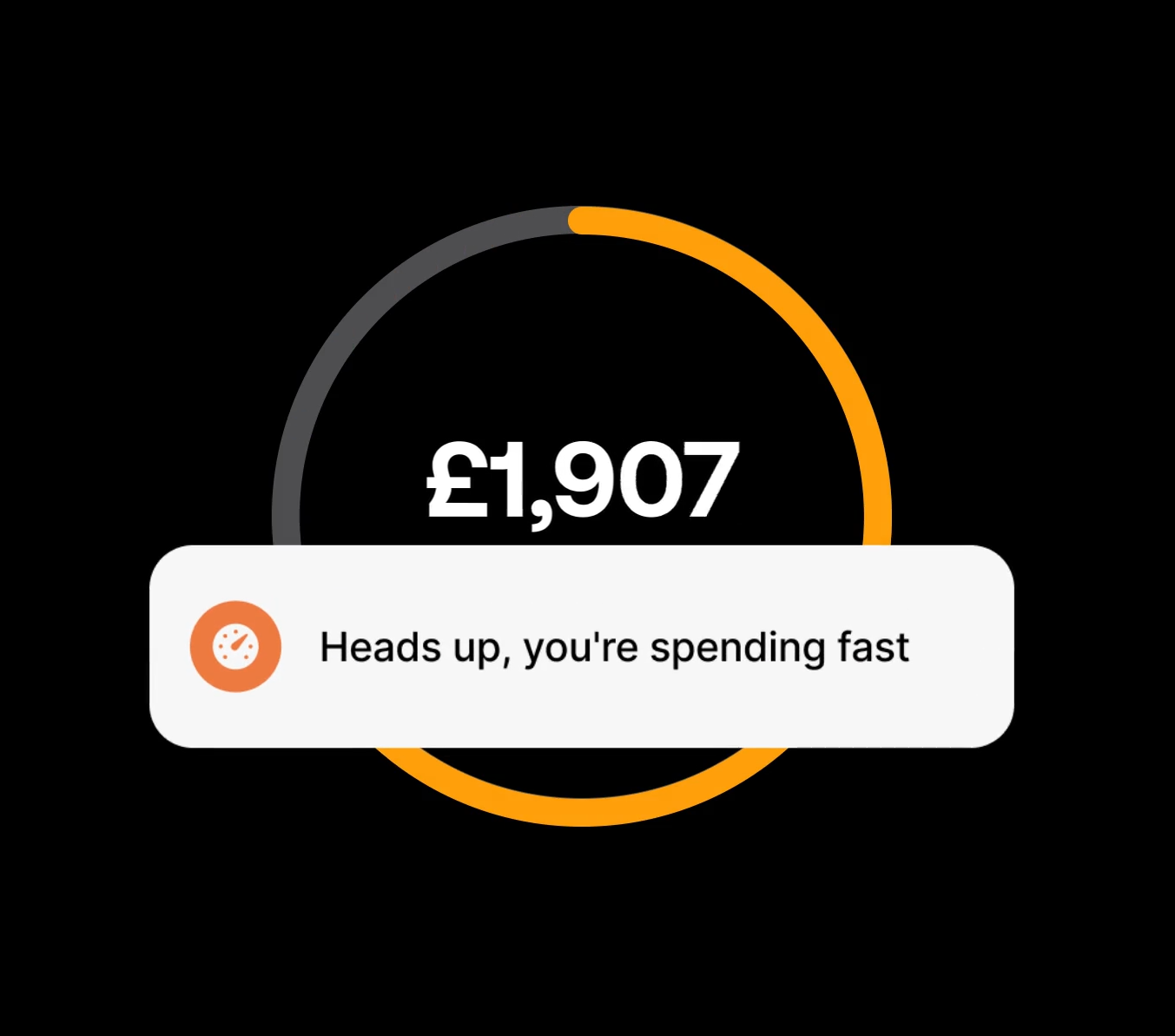

Monzo

A huge selling point of Monzo is its lack of fees for spending money abroad, but you’ll find lots of handy features that make the banking app worthwhile for budgeting.

Pots: split your money into pots (Piggy-banking technique) so you can categorise your spending.

Put your savings into a 12-month Fixed Pot with a £500 deposit when you open and earn up to 3.55% interest.

Apply round-ups to your accounts so you can money aside without even thinking about it.

Monzo automatically categorises your spending, but you can manually alter categories to keep it accurate. You can view each category to see how much you’re spending on transport, groceries, shopping, and more.

Set budgets for how much you spend on each category and receive warnings if you’re spending them too fast or reaching your limit.

Check the summary page from your account to see how much money you have left to spend, minus any upcoming payments and direct debits.

Starling Bank

Starling is an app-based current account that has won awards for its banking service.

- Separate your spending with Saving Spaces using the Piggy-banking technique. Set targets and track your progress within each space.

- Use their Bills Manager to put money aside for bills that will get paid automatically.

- Analyse your spending habits with the Spending Insights tool that gives you a breakdown of where your money goes every month.

- Set limits on where you can spend and how much, whether it’s weekly contactless amounts or entertainment purchases.

- Lock away savings into a one-year Fixed Saver account and get a guaranteed return of 3.25%.

- Their Round Ups feature means you can add pennies to your Saving Space with every spend.

Create your own budget spreadsheet

You can always go the manual route if you prefer to see all your incomings and outgoings in one place. Make sure your calculations are correct by using an Excel spreadsheet rather than pen and paper so you can add formulas that will automatically figure everything out for you.

It’s easy enough to set up a basic spreadsheet (you can get more sophisticated if you’d like) with formulas. Once you’ve set it up, all you’ll need to do every month is add or adjust the figures to see what you have left to stay within your budget and goal.

If you already have some Excel skills, you can mock up your own version that’s customised to what you want.

Save money at 5,000+ top-named brands

What to do if you’re overspending or in debt

Money management can get stressful, especially if you’re spending more than you earn or are heading into debt. While there may be months when you splash out or don’t plan your finances well, if you find you consistently overspend, there are steps you can take to get back on track.

1. Analyse your discretionary spending

Go through your bank statements to analyse your spending. Sort your spending habits into categories like fixed essentials, non-fixed essentials, and non-essentials then consider how much you’re spending for each category.

Starting with non-essentials and nice-to-have items, take an inventory of each and every purchase you made over the last couple of months. What can you cut out? Some examples that you could reduce are takeaway coffees, trips to the cinema, alcohol, weekly takeaways, online shopping, and buying lunch.

If you can create a weekly allowance of your disposable income, you’ll still be able to enjoy these things within a reasonable amount.

Take a look at essentials with no fixed amount that you may be able to cut down on. How much do you spend on your weekly food shopping – is it more than the UK average of £31 per person? Can you walk, take public transport, or carshare to reduce the amount you spend on petrol?

2. Prioritise your debt

If you have debts to pay off, focus on paying off those with the highest rate of interest first. These can be store cards, personal loans, or credit cards. Make sure you’re always paying at least the minimum amount due each month, and use any reductions in your personal spending to pay off more. Handy tools like round-ups can be put towards this.

It’s also worth calling up your credit card or loan provider to negotiate a lower interest rate or let them know if you’re having problems keeping up with payments.

3. Negotiate your bills

Even if you have essential bills with a fixed monthly payment, there may be things you can do to help with this. When it comes to broadband suppliers, phone plans, and even mortgage payments, get in touch to see what you can negotiate to lower your bill or change your contract.

What you absolutely shouldn’t do is fail to pay any of your important bills. This can incur penalty fees, negatively affect your future credit score, or result in your utilities being cut off.

If you are struggling with your utilities, get in touch with the company to let them know you can’t pay. Certain companies like energy suppliers have an obligation to help you if you can’t pay. The earlier you contact them, the quicker you can work something out, like a repayment plan, more time, reductions, or assistance.

4. Make extra cash

Consider what assets you have at home and see what you could rent out or sell. You can make extra cash by selling unwanted clothes and home items that are in good condition.

There is also a growing market for renting out things you own, like your driveway, car, spare room, or designer clothing. Selling your extra things provides finite income, but can definitely help short term to help pay off debt.

Resources for severe debt

There are places you can go for dealing with debt, so you don’t need to suffer in silence. Contact specialist services like StepChange Debt Charity, Citizens Advice Bureau, or National Debtline to get free, confidential, professional advice on managing debt. They’ll be able to put you on track to tackle your arrears and start you on debt management plans with the companies you owe.

Reaching out is the first step to solving your financial problems, although it can be the hardest one. You may find that some companies will be more willing to adjust your payments or interest if they know you’re working with reliable debt relief charities like StepChange.

Have you recently started a budget? What tips do you find useful or would you like to know more about?

The information contained within this article is for editorial purposes only and is a general guide and description of the products listed above. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.

Selling unwanted second hand stuff is environmentally friendly too, love the idea

Hi Winnie,

We completely agree and have two whole guides on buying and selling second hand 🙂

~Amy

Brilliant info

Thanks Richard 🙂

~Amy

Good points I will be sending this to my daughters

Thanks Paul 🙂

~Amy

I love budgets. They allow you to see where your money is going rather than using online banking that only gives you a balance about that day.

Hi Sarah,

Glad we could help!

~Amy

Always use spreadsheet to control my budget. Personally, I found it practical on spreadsheet as you don't have to manually key each transaction especially when there are repeated standing orders and direct debits.

Hi Corinne,

We totally agree! Very useful, thanks for your comment 🙂

~Amy

Thanks

Great information already with Starling Bank they are brilliant.

Hi Dawn,

Glad you agree, thanks for your comment!

~Amy

Nice and helpful article

Thanks Agnieszka, hope you got some good tips 🙂

~Amy

Ready-made New Year's resolution! 🙂

That’s great Deborah!

~Amy

Excellent

Thanks Mark 🙂

~Amy

Putting little bits away mount up rather than one big chunk that leaves you with no!! Don't rob Peter to pay Paul is a saying and I shall be carrying this forward into 2024

Great motto Louise, we totally agree!

~Amy

I have been doing the 1p challenge for a number of years now. In recent years since Covid I have done this by transferring the monthly amount to a separate savings account and have set up a separate savings pot with Chase Bank to do this. A great way to save without the pain.

Hi Michael,

We’ve heard of this too, what a great idea! How much do you get at the end of the year?

~Amy

Some great tips and points made. Buying and selling second hand items on Vinted/Charity shops helps unwanted clothing going into landfill

Hi Michelle,

Thanks for your comment! We totally agree – have you seen our guides to selling clothes and buying second hand?

~Amy

Lots of useful information & tips

Thank you Jess 🙂

~Amy

I've sold many things on Vinted where there is no selling fee which has been great.

Hi Ceri,

We love Vinted too! We have a full guide to selling clothes that includes other techniques too.

~Amy

2024 is the year I get it together for saving!

You got this Gemma!

~Amy

I track my income / outgoings in a notebook every month. It helps with budgeting and savings, and alleviates financial stress knowing where my finances are at.

This is a great article! Thank you! 😊

Thanks Dawn, it’s great to stay on top of things, glad you enjoyed.

~Amy

Thanks for the tips – I’m starting to use more cash instead of debit card and you do watch what you are spending

Hi Nicky,

Glad you like the tip, it’s definitely effective!

~Amy

Savings account and tin for coins

Hi Sarah,

Sometimes the simplest techniques are the best!

~Amy

Some great topics, a good read.

Thank you Anna!

~Amy

Thank you very much for sharing, I learned a lot from your article. Very cool. Thanks.