The information contained within this article is for editorial purposes only and is a general guide and description of the products listed. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.

So you’ve managed to secure yourself a degree – congratulations! Your hard work has paid off and now you’re ready to embark on your graduate journey.

You may think this means that your student bank account perks are coming to a close. But what if we told you the end of your student days doesn’t have to be the end of all the bank perks?

We’re here to guide you on what a graduate account is and the different graduate accounts available in September 2024.

No matter your post-uni plans, there’s a wide range of graduate accounts available during your early graduate days to help you get on track with your finances.

What is a graduate account?

A graduate account is designed for those who have graduated from higher education, usually in the last three years. They offer perks that a standard current account doesn’t, such as an arranged overdraft and no monthly fees.

Graduate accounts tend to need a minimum monthly deposit to keep the account open so you will need to have your income paid into the account.

What to look for in a graduate account

There are several things you ought to think about when deciding on which bank to set up a graduate account with:

1. Can you set up a graduate account with a bank you don’t have a student account with?

Although not all, most banks will only allow you to have a graduate account with them if you’ve had a student account with them. Your student account will automatically turn into a graduate account with your student bank provider in most cases too.

The only banks offering you to apply for a graduate account without having their student account are:

Top tip: If you’re still at university and have a student bank account, you may be able to change your student bank account so that you can have a graduate bank account with your preferred bank. Be sure to check if your bank allows you to swap student banks accounts.

2. Look for what the bank offers as perks

This could be an extension of their student account perk or an entirely new graduate account perk. Be sure to check what incentives are offered with the graduate account to help with your early career finances.

3. Look at how much overdraft they offer and for how long

Most graduate accounts offer an arranged overdraft for two to three years. This often reduces year-on-year so it’s good to check the overdraft size and length for your graduate account.

You should always do your research on bank accounts and should never be borrowing money that you can’t afford to pay back.

Graduate account options

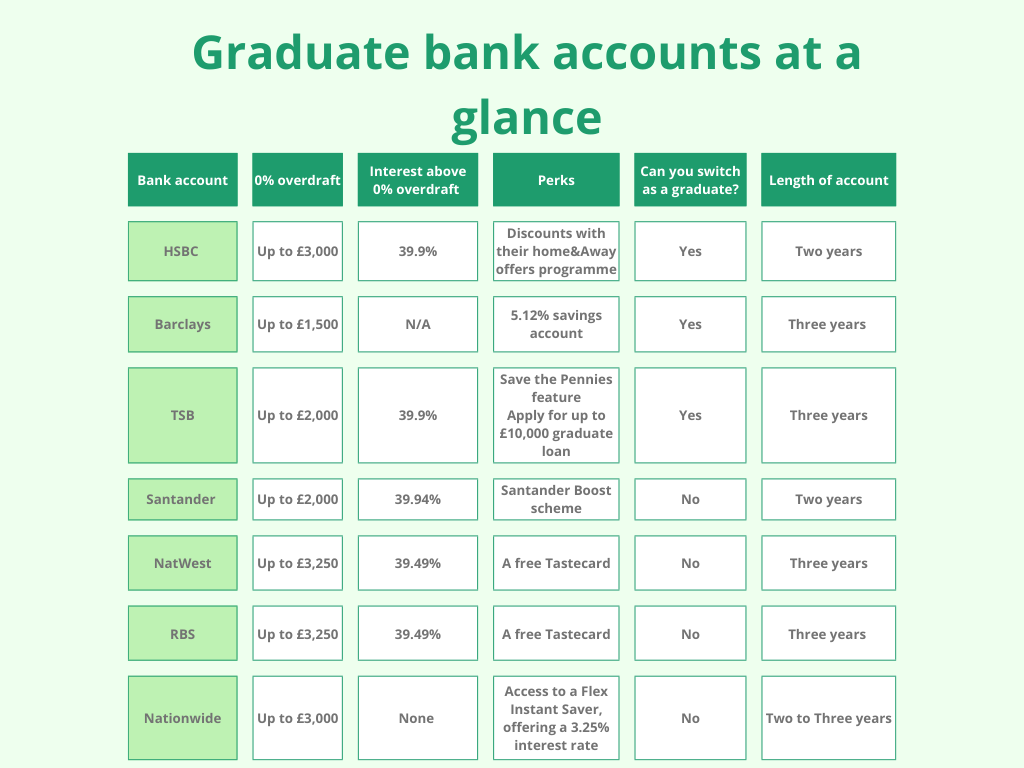

Here are all the banks who have a graduate account and a breakdown of each bank account:

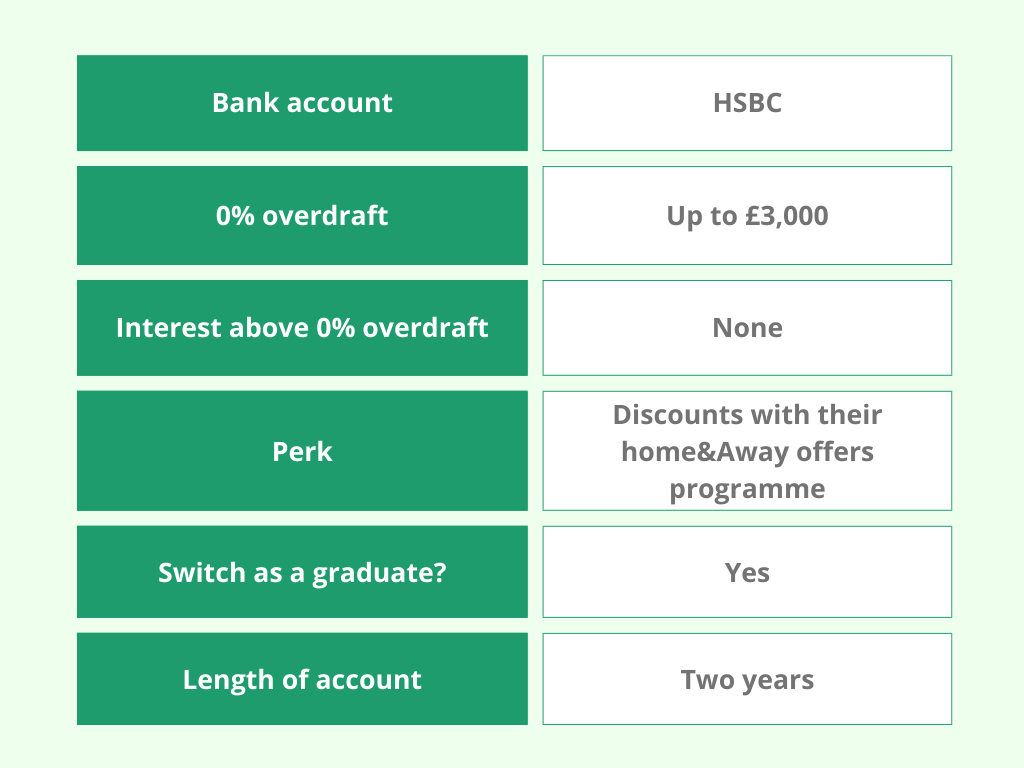

HSBC

You can apply for an HSBC graduate account if you have graduated in the past two years, even if you haven’t had a student account with them.

Length of graduate account:

Two year account, then you get moved to an Advance account or an HSBC account.

There’s a possibility that you could be granted an overdraft of up to £1,000 with your moved account. However, this will depend on how you’ve used your account in the past, as well as your personal circumstances.

Interest free overdraft:

Year one: up to £3,000

Year two: up to £2,000 (subject to status)

Interest above overdraft allowance:

39.9% EAR.

Perk:

Get discounts on shopping, dining, travel and experiences with their home&Away offers programme.and a ranking.

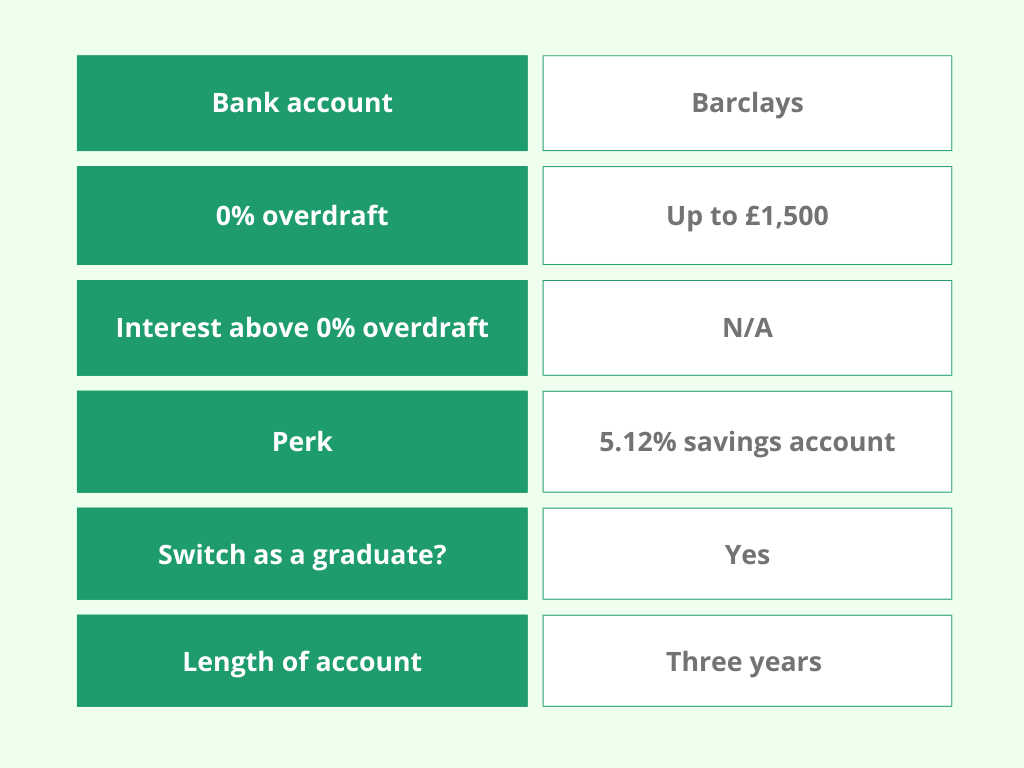

Barclays

You can apply for a Barclays Higher Education Account if you’ve finished your studies within the last three years, even if you haven’t had a student account with them.

Length of graduate account:

Up to three years, then you get moved to their current account.

Interest free overdraft:

Up to £1,500 for up to three years.

Interest above overdraft allowance:

You can't borrow any money over your maximum overdraft allowance.

Perk:

Access to a 5.12% savings account.

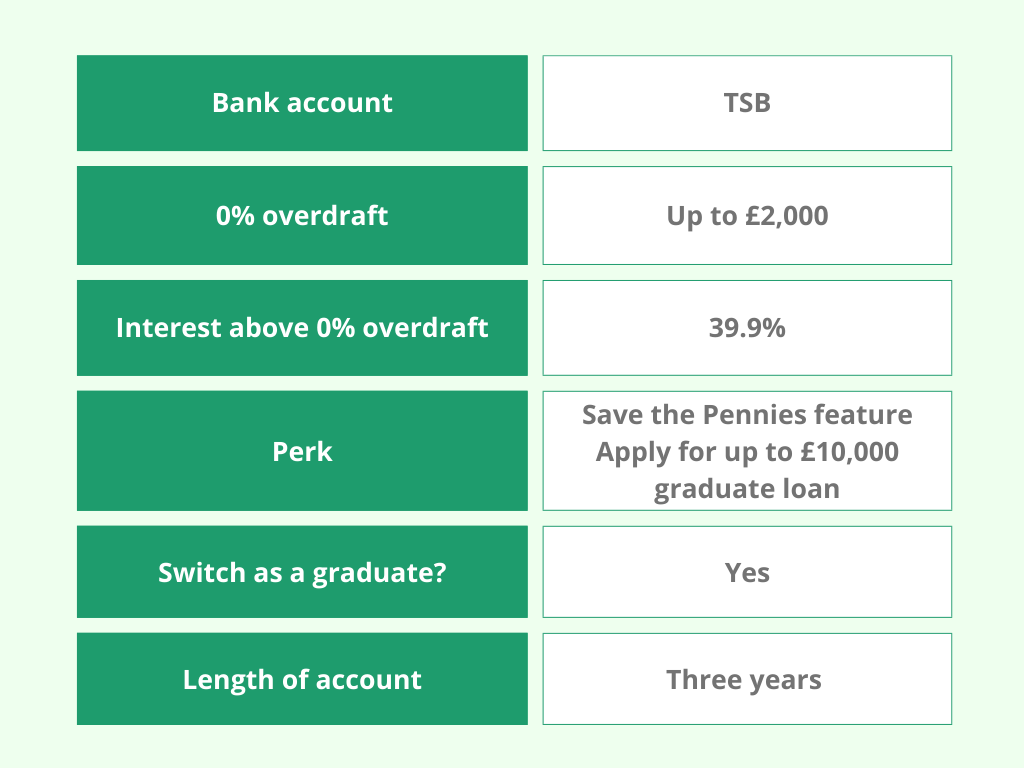

TSB

Any UK citizens who have graduated in the last three years can apply for a TSB Graduate Bank account.

Length of graduate account:

Up to three years, then you get moved to a Spend & Save account.

Interest free overdraft:

Up to £2,000 for up to three years.

Interest above overdraft allowance:

39.9% EAR.

Perk:

Save the Pennies feature to help save more money.

Apply for up to £10,000 graduate loan.

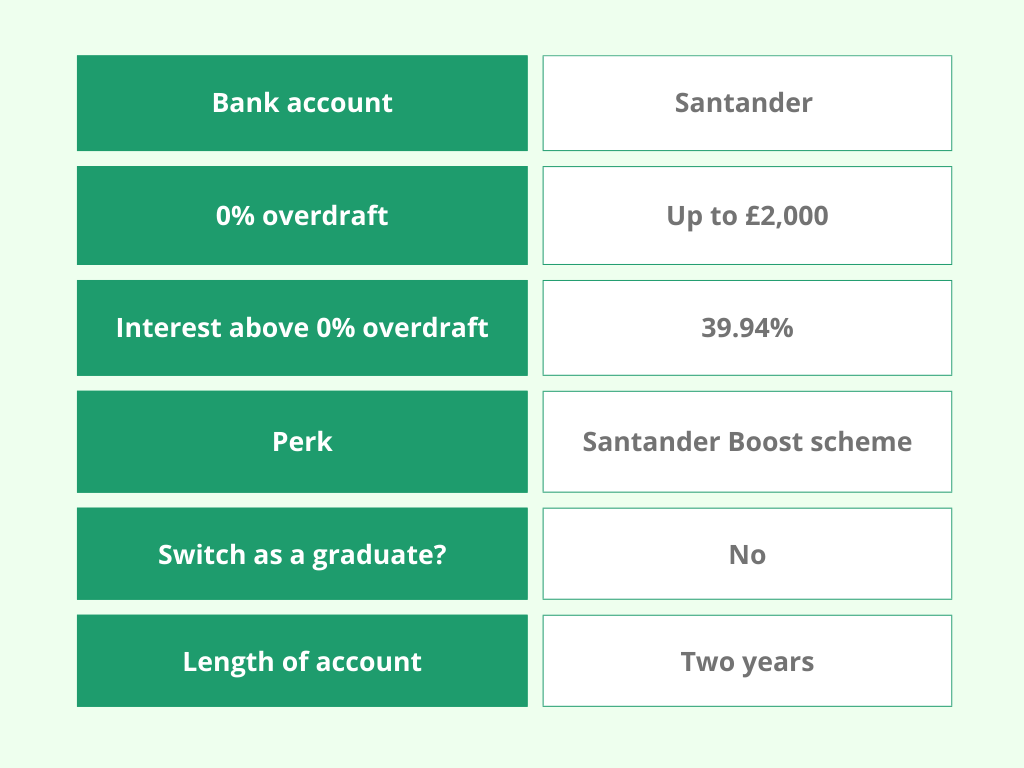

Santander

You will need to have had a student or a postgraduate account to have a Santander graduate account.

Length of graduate account:

Up to two years, then you automatically get moved to one of their current accounts.

Interest free overdraft:

Up to £2,000 for up to two years.

Interest above overdraft allowance:

39.94% EAR

Perk:

Access to the Santander Boost scheme where you can earn cashback on select retailers.

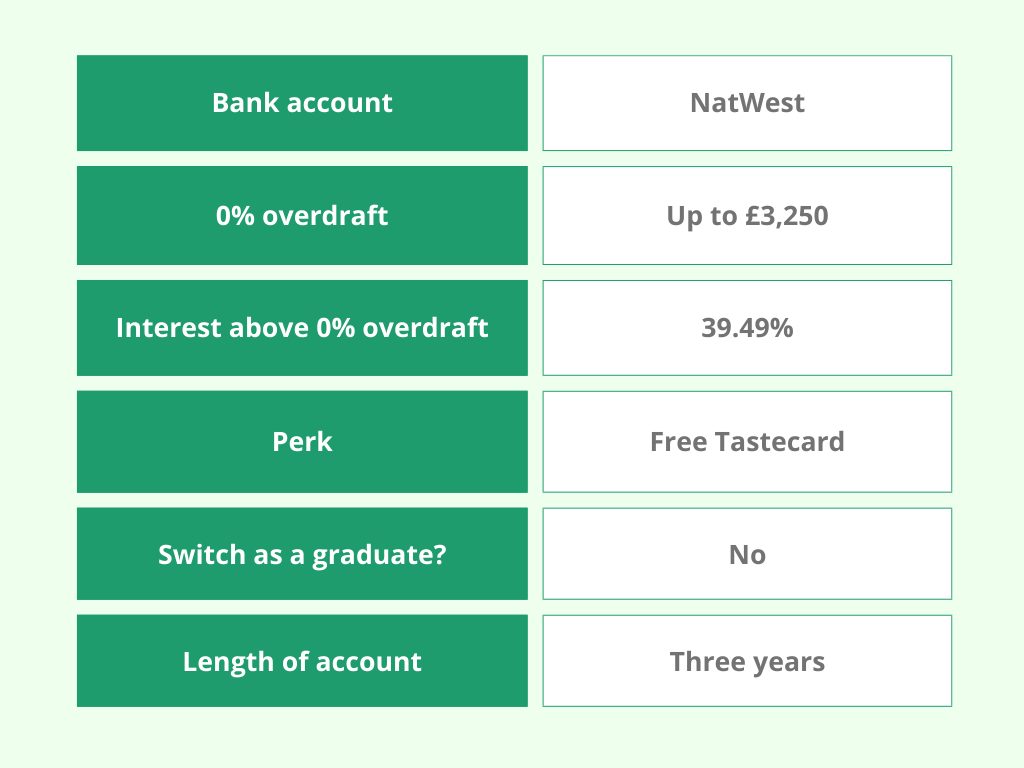

NatWest

You need to have had a NatWest student account to be eligible for their graduate account.

Length of graduate account:

Up to three years, then you get moved to a Select account.

Interest free overdraft:

Year one: up to £3,250

Year two: up to £2,250

Year three: up to £1,250

Interest above overdraft allowance:

39.49% EAR.

Perk:

A free Tastecard that gives up to 50% off at selected restaurants.

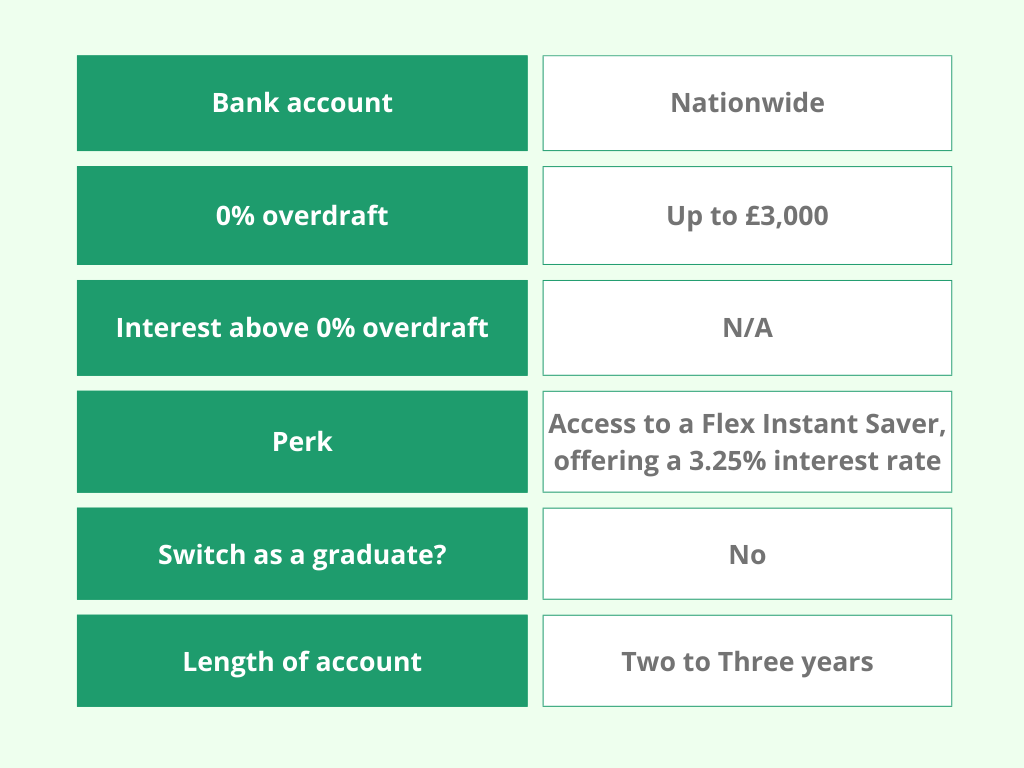

Nationwide

You need to have had a Nationwide FlexStudent account to be eligible for a FlexGraduate account.

Length of graduate account:

Two to three years depending on the length of your course. Your account will then be made into either a FlexDirect or a FlexAccount.

Interest free overdraft:

Up to £3,000 when you first graduate.

One year post-graduation: up to £2,500.

Two years post-graduation: up to £1,750.

Three years post graduation: up to £1,000.

Interest above overdraft allowance:

You can't borrow any money over your maximum overdraft allowance.

Perk:

Access to a Flex Instant Saver, offering a 3.25% interest rate.

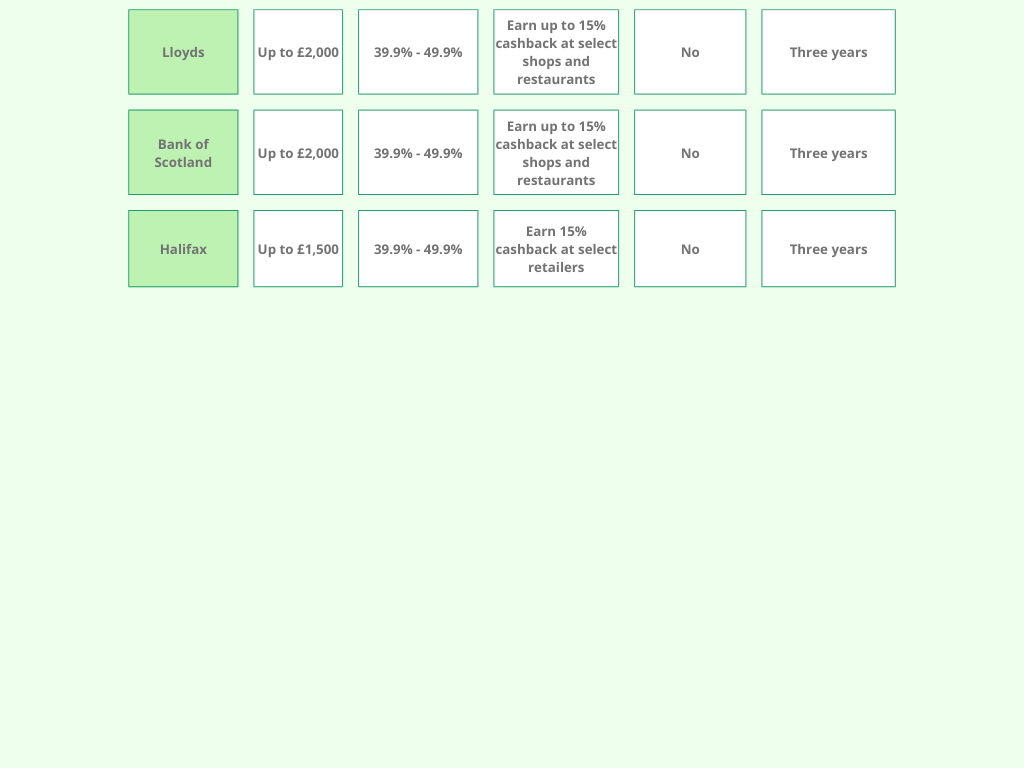

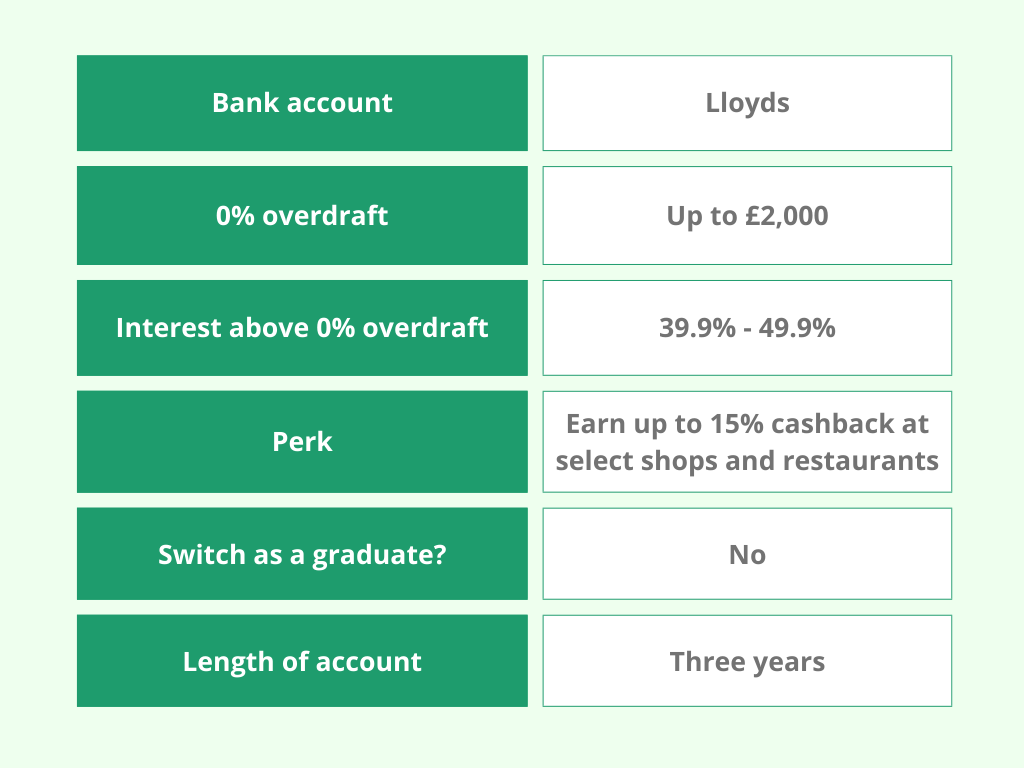

Lloyds

You can only have a Lloyds graduate account if you’ve had a student account with them.

Length of graduate account:

Up to three years.

Interest free overdraft:

First year: up to £2,000

Second year: up to £1,500

Third year: up to £1,000

Interest above overdraft allowance:

39.9% EAR - 49.9% EAR.

Perk:

Earn 2.0% EAR interest monthly when your account is in credit.

Earn up to 15% cashback at select shops and restaurants.

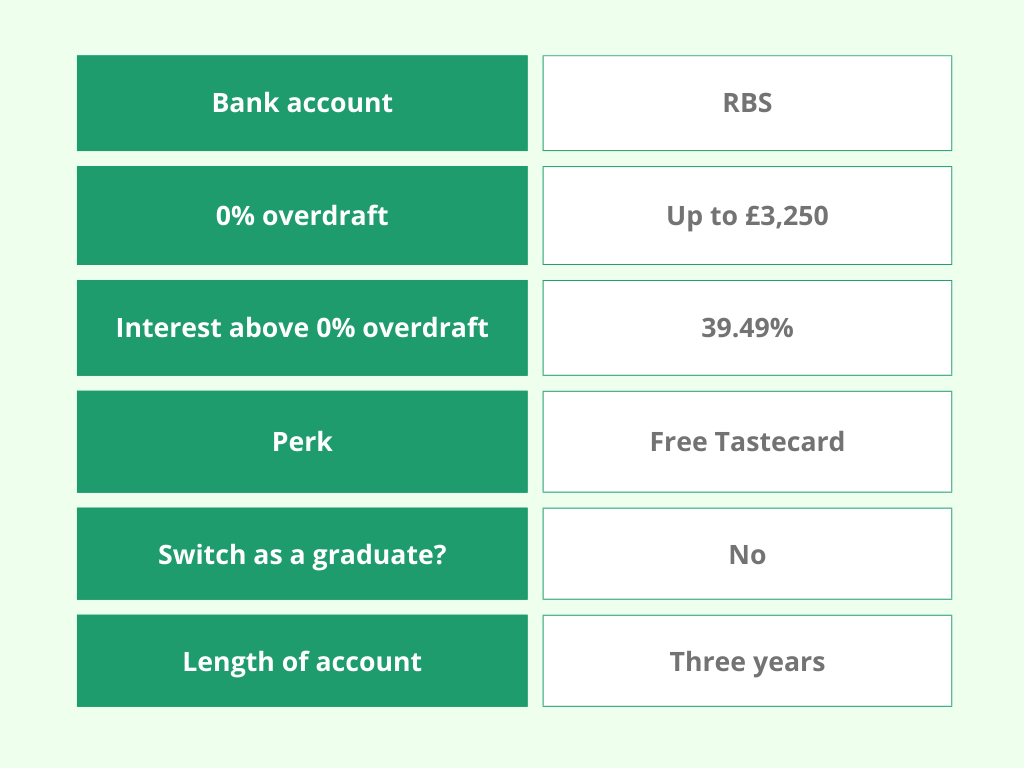

RBS

You need to have had a RBS student account to be eligible for their graduate account.

Length of graduate account:

Up to three years, then you get moved to a Select account.

Interest free overdraft:

Year one: up to £3,250

Year two: up to £2,250

Year three: up to £1,250

Interest above overdraft allowance:

39.49% EAR.

Perk:

A free Tastecard that gives up to 50% off at selected restaurants.

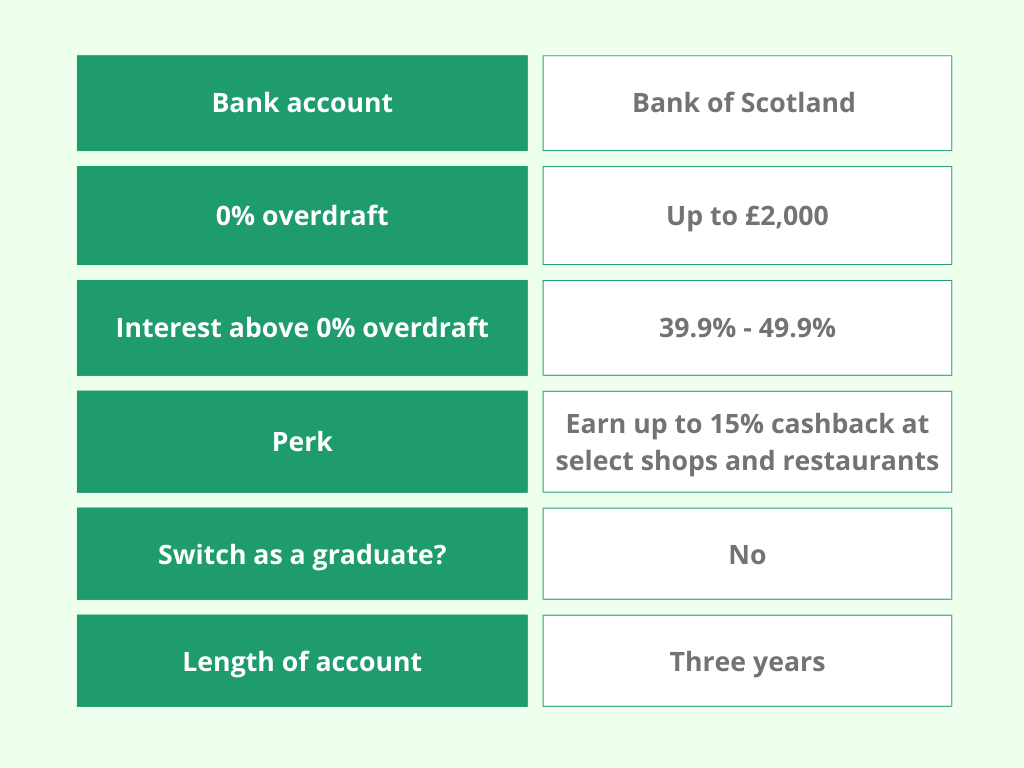

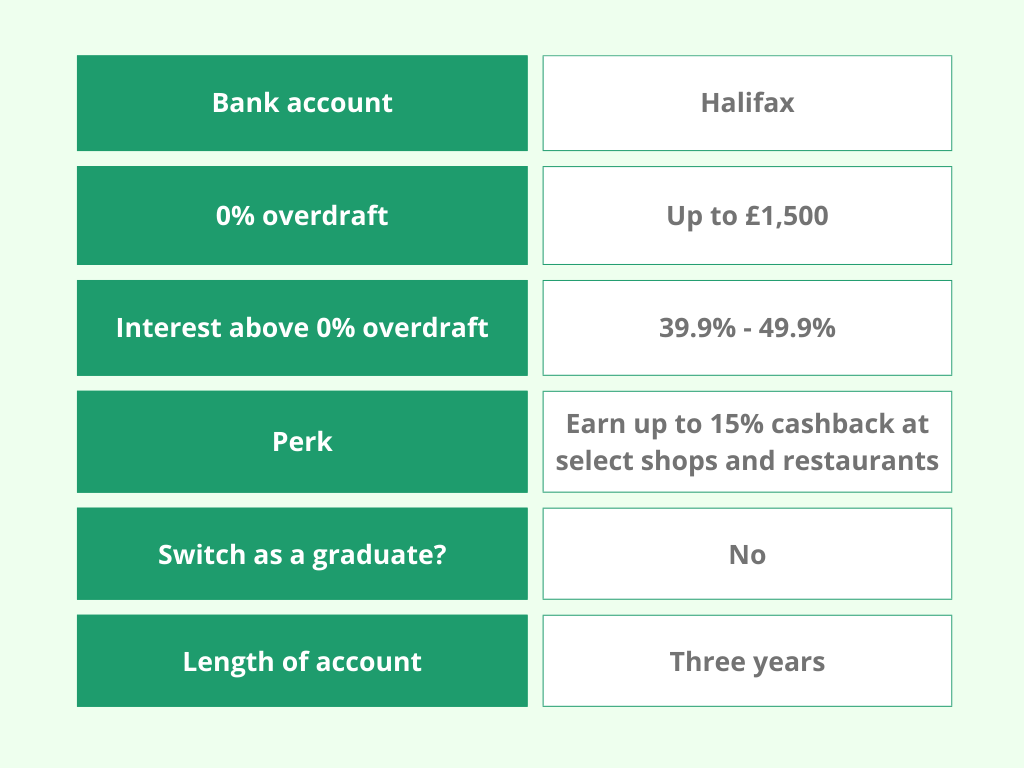

Halifax

You need to have had a Halifax student account to be eligible for their graduate account.

Length of graduate account:

Three years before they turn your account to a current account.

Interest free overdraft:

Up to £1,500 for up to three years.

Interest above overdraft allowance:

39.9% - 49.9% EAR.

Perk:

Earn 15% cashback at select retailers.

Graduate Account FAQs

A graduate account is a bank account specifically designed for those who have graduated from university. They have perks such as an arranged overdraft for up to three years, no monthly fees and other bank-specific perks.

If you have a student bank account, it will automatically become a graduate account with the bank you had your student account with when you graduate.

The only student bank account that doesn’t turn into a graduate account is the Co-op student account.

This varies depending on which bank you are with, but they tend to last two to three years from when you graduate.

If you already have a student bank account, your account will automatically become a graduate account once you’ve graduated.

If you don’t have a graduate account but have recently graduated, you will be able to apply for a graduate account with either TSB, HSBC or Barclays.

Graduated? Bank smart with the right account

Now we’ve discussed all the different graduate account options, you should have a better idea of your next step.

Here’s what you need to remember:

Most graduate accounts are only available to people with existing current accounts with that provider.

Your student account will most likely automatically turn into a graduate account after you graduate.

Your overdraft will reduce each year that you have your graduate account to help you manage your finances.

The information contained within this article is for editorial purposes only and is a general guide and description of the products listed above. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.

Have you had any experiences with one of the graduate bank accounts we’ve discussed? We’d love to hear from you if you can share any extra information for readers looking to set up a graduate account.

Get £15 cashback for joining TopCashback

Get £15 cashback for joining TopCashback