Congrats — you’re buying a house! While our grandparents might have had an easier time getting (and staying) on the ladder, buying a property in 2025 is a huge achievement.

There are many aspects of the house-buying process that can be confusing, especially if you’re buying your first home.

But don’t worry — we’re here to help.

In this guide, we’ll explain what a house survey is, how each type of survey works and how much yours is likely to cost you.

It doesn’t matter if you’ve done this before or you’re a first-time buyer, keep reading to learn what type and level of survey you'll need for the property you're buying. We also answer common questions, from how to find a surveyor to how to interpret your report.

Quick answer: How much does a house survey cost?

House surveys can cost anywhere between £300 and £1,500, depending on the property and the level of detail required for the report. Larger or older properties, for example, usually require a more in-depth structural survey.

Skip ahead if you’re looking for a breakdown of the main house survey types and the costs.

What is a house survey and do I need one?

Buying a property comes with risks – that’s something you can’t really avoid.

A house or flat might look beautiful in the pictures, but there could be all kinds of nasty surprises hiding behind the wallpaper or under the floorboards (or in the attic!).

House surveys (also called property surveys) are inspections that help home buyers alleviate some of the risks that come with purchasing a home. They aim to determine whether the property is worth the amount you're paying by uncovering any urgent defects or issues.

If you're buying a new build home directly from a developer, you may not need a traditional property survey. Skip ahead to our new build buyers section for more information about this.

House surveys are usually carried out by a RICS-registered chartered surveyor (RICS stands for the Royal Institution of Chartered Surveyors). They will visit the property on your behalf and assess its condition, checking:

- The general condition of the property

- Any specific structural problems (or potential structural problems)

- Any maintenance issues

- Any risks associated with the property's location (e.g. flooding, radon gas)

While getting a house survey is not a legal requirement to buy a property, many mortgage lenders will require you to get one before agreeing your mortgage.

And they have big benefits for you as a buyer too. Your survey report will let you know if the house you're buying has any major problems that could cause you trouble later down the line. This will help you to make a more informed decision, which is essential when large sums of money are involved.

If your inspection uncovers any significant problems, you may want to use your report to negotiate the purchase price. You might even decide not to purchase the property at all.

What level and type of survey do I need?

The type of house survey and the level of detail it goes into will depend on the age and condition of the property. Larger, older, and more unusual properties require more in-depth surveys.

There are three different levels of RICS Home Surveys, starting from Level 1 (most basic) to Level 3 (most thorough).

These reports will look similar, using a traffic light ratings system to highlight potential defects and issues from most to least significant. Most people need a RICS Home Survey Level 1 or Level 2, as these are suitable for most conventional properties in reasonable condition.

The amount of detail your surveyor goes into will depend on the level of the survey. The level of survey you need will depend on a few factors:

- The type of property

- The size of the property

- The property’s condition

- How old the property is

- Whether the building is unusual or a listed building

- Whether there have been any significant changes made to the property

- Whether you plan to make any significant changes to the property yourself

We’ve outlined the three levels of RICS Home Surveys below to give you an idea of how much you can expect your survey to cost.

Bear in mind that the price brackets are broad; the exact price you pay will depend on the property you’re buying and the company conducting your survey.

Information about price estimates has been sourced from HomeOwners Alliance. You may find that your survey costs more or less than the amount estimated in this guide.

RICS Home Survey - Level 1

How much will it cost? £300–£900

What homes is it best for? Modern homes that appear to be in good condition

The RICS Home Survey - Level 1 (previously known as a RICS Home Condition Report) is the most basic survey. It's designed to give you a general overview of the condition of the property, alerting you to any visible defects and urgent problems.

A Level 1 survey report will include the following things:

- A standard visual inspection of the construction and condition of the property (both inside and outside)

- Identification of any serious or urgent defects

- Identification of any potential issues that may be a risk to safety or the fabric of the building that will need further investigation

A RICS Home Survey - Level 1 is best for homes that are less than 50 years old and in good condition. As it’s only a non-intrusive visual inspection, the RICS surveyor will only inspect the chimney and roof from ground level and they won’t lift any carpets, floor coverings, furniture or insulation.

RICS Home Survey - Level 2

How much will it cost? £400–£1,000

What homes is it best for? Conventional properties that appear to be in good condition

RICS Home Survey Level 2 has previously been known as a Home Buyer Report or Homebuyer Survey. You may also hear about RPSA Home Condition Surveys, which are equivalent to the RICS Home Survey Level 2, but conducted by the RPSA (Residential Property Surveyors Association).

The RICS Level 2 is a mid-level survey that’s more thorough than a Level 1 survey, although it is still defined as non-intrusive, as the surveyor will only carry out a visual inspection. A Level 2 survey will cover all of the things covered by a Level 1 survey, as well as providing:

- A more thorough report on the condition of the property and any potential defects

- A breakdown of any issues that may affect the property value (such as damp and dry rot)

- More detail on the condition of the roof space and drainage chamber

- Advice about ongoing maintenance the property may need in the future

- Recommendation to seek out extra advice before going ahead with your property purchase if needed.

You can also opt to have a valuation added to your report, for an additional fee. The surveyor will provide a market value for the property, as well as an estimate for your insurance rebuild costs.

A RICS Home Survey - Level 2 will best suit houses that are less than 50 years old and appear to be in a reasonable condition. Even if the property you’re buying qualifies for a Level 1 Survey, you might still want to opt for this slightly more thorough report.

RICS Home Survey - Level 3

How much will it cost? £630–£1,500

What homes is it best for? Larger or older houses, unusual properties, and properties that have had significant modifications

The RICS Home Survey Level 3 was previously known as a RICS Building Survey and sometimes also referred to as full structural surveys. You may also hear about RPSA Building Surveys, which are the RPSA equivalent.

The RICS Home Survey Level 3 is the most comprehensive survey you can have carried out. These are often tailored to the individual property, surrounding area and materials used. They are still defined as non-intrusive.

On top of all the features of the Level 1 and Level 2 surveys, this report will also:

- Help you make a decision about purchasing the property, including planning for repair work or maintenance

- Provide more detailed advice on the condition of the property

- Identify any risks that may be posed by potential or hidden defects

- Provide you with the most probable cause (or causes) of those specific defects

- Provide an estimate of the costs and timescales associated with making the identified repairs

- Recommend any further actions or advice needed before you commit to buying the property

A Level 3 survey will give you a comprehensive assessment of the property’s structure and condition.

You’ll want to consider this survey if the property you’re buying is over 50 years old or is larger or more unusual than the average property. Another reason to go for this level would be if the property has had any significant modifications in the past or if you intend to modify the property yourself.

Organising your house survey

Here are a few important things to consider when you’re looking to organise your house survey. Remember to seek out professional advice if there’s anything you’re not sure about or would like clarification on.

Who books your house survey?

It’s usually you, the home buyer, who is responsible for booking a house survey.

However, some mortgage brokers will be happy to organise this on your behalf, or offer advice as to which survey they recommend for your property. Your solicitor may also be able to recommend a local surveyor for you.

If you’re booking your own survey, choosing a reliable, qualified chartered surveyor is of utmost importance. Make sure you check that they’re RPSA or RICS-accredited.

You may also want to compare quotes from a few different property surveyors to ensure you’re getting the best price. Your broker will also be able to advise you on what constitutes a reasonable price for your property survey.

When to book your house survey

House surveys are carried out after you’ve had your offer on a property accepted, but before you exchange contracts.

It’s important that you only pay to have a house survey carried out once you’ve received assurances from the seller that they are serious about selling the property to you. Otherwise, you may end up spending unnecessary money on a survey for a property you don’t actually end up buying.

The ideal time to book your survey comes after you’ve instructed your solicitor. This means you’ve spoken to a solicitor (a lawyer who specialises in transferring ownership of property) and formally asked them to act on your behalf.

They will order local council searches on your behalf and handle the contracts. Once they’ve ordered your searches and you’ve had the draft contracts from the seller, this is the time to book your house survey.

Your next steps after receiving your report

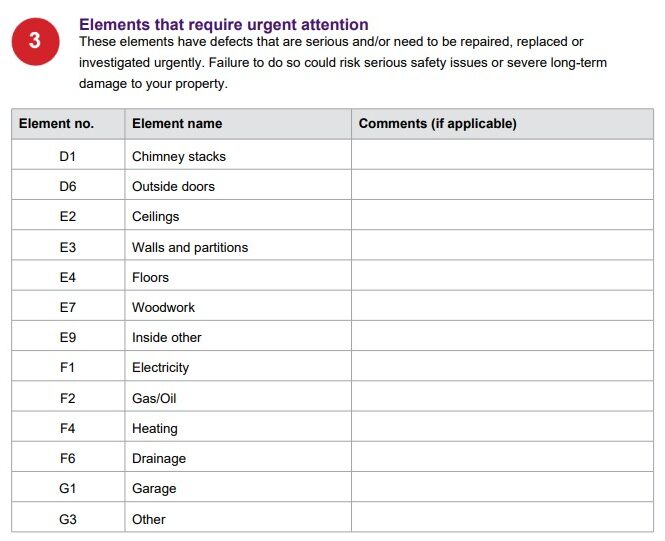

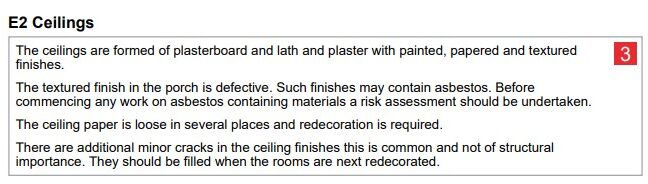

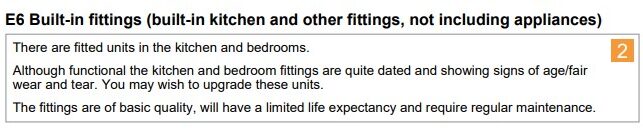

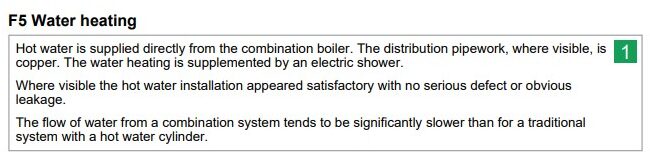

You should receive your detailed report within 10 days of the survey. It will be structured using a traffic light system, where aspects of the property and surrounding area are labelled red, amber or green. You may also see some aspects labelled ‘NI’, which stands for ‘not inspected’.

Red ratings

Red ratings

Red ratings point to things that require further investigation or immediate repair. Areas marked as red are your biggest concern, as these may refer to severe defects that should be acted upon immediately.

If you have any significant or expensive issues flagged by these red ratings, you may want to negotiate on the property price or reconsider your purchase altogether.

This is especially important if your mortgage lender requires you to fix any of the things flagged red before you move into the property, as these fixes may cost you a lot of money.

Amber ratings

Amber ratings

Aspects given an amber rating are still worth paying attention to. These will point to defects that need repairing or replacing, although they may not be serious or urgent. Areas flagged as amber may not need addressing right now, but if left unaddressed, they could develop into severe defects.

Green ratings

Green ratings

Any aspects given a green rating are things that don’t require any repairs or further investigations.

If your house survey report highlights significant problems with the property or surrounding area, you might want to consider whether you still want to go ahead with buying the property at all.

This is something you should consider speaking to an independent financial advisor about, as they can help you make sense of your report and lay out your options for next steps. Your report will contain a huge amount of information, and you might need the help of an expert (such as your mortgage broker) before you can be sure of your next move.

If the issues are significant but not severe, you can use your report to attempt to re-negotiate on price. Alternatively, your estate agent to speak to the seller and see if they’re willing to fix any of these issues themselves.

Bear in mind that your lender may reduce how much money they're willing to lend you because of the report's findings, as the issues may affect their opinion of the value of the property.

Your report will also contain a page for your solicitor that will outline any issues the surveyor thinks need further investigation. This could be anything from confirmation of local authority approval for extensions and window replacements to information relating to boundaries.

Fran at TopCashback recently paid for a house survey:

“When buying my house, I had a Level 2 Homebuyer survey as the property was built in the early 90s and needed renovating.

I paid £500 for the survey and it highlighted a few urgent areas of work that need to be sorted immediately (such as clearing blocked gutters and vents) and some more long-term remedial works.

We bought the house knowing it needed a lot of work doing and money spending on it and the survey has helped us to plan what work to complete first and how to budget for the renovation costs.”

New build snagging surveys

How much will it cost? £300–£600

New build properties don’t typically require traditional house surveys, but that’s not to say there aren’t things you can do to check the structure and quality of your new home.

A new build snagging survey will identify issues with the property, including anything unfinished, of insufficient quality or that breaches building regulations or warranty standards.

Your snagging inspection will cover a range of areas in your new home, using what’s called a snagging checklist. They may uncover issues such as:

- Unlevel floors

- Cracked or scratched windows

- Surface cracking to interior walls and ceilings

- Insecure stair rails

- Paint blemishes

- Damaged fixtures and fittings

- Faulty light switches

- Sticking doors

- Exterior drainage issues

- Damaged roof tiles

- Insulation defects

There are two types of new build survey: pre-completion and post-completion. As you might guess, the former is done before completion (so, before you get the keys), while the latter is done after completion, when you're the legal homeowner.

When people refer to snagging surveys, they're most often talking about post-completion surveys. These are the most common choice when buying a new-build as they're more in-depth. You can have both types carried out if you'd like, although this will be expensive.

If you're getting a post-completion snagging survey, try to get this done within the first week of you getting the keys. This is because the developer will check in with you after seven days to discuss any questions or concerns you have.

Fran told us about her past experience with fixing snags in her new build home:

“I've had two new builds before and both developers were fine about snagging. Generally the site manager or deputy site manager deals with them and if you are nice to them they will do anything to help.

My daughter put an apple down the toilet not long after we moved in and flushed it. She didn't tell us and we didn't know why the toilet was backing up. Our developer cleared it and we never got charged for it.

The only thing I've found that they won't deal with is plaster cracks from the house settling. We had to sort that ourselves.”

You might want to speak to a few different professional snaggers (that's the surveyor who conducts your new build survey) to get survey quotes so you can find the best price. The price you pay will also depend on the size of the property.

Your builder has a responsibility to fix any snags in your property. You usually have a two-year period within which you can raise snags with the developer and get them fixed free of charge.

Your new build developer might offer to conduct a snagging survey on your behalf, using a snagging company they are affiliated with.

Unless they'll do it for free (and you're still planning to get your own snagging survey done), we wouldn't advise taking them up on this offer.

An independent snagger with affiliation with the company that built your house will have a more critical eye and offer more in-depth findings.

Home survey FAQs

Looking for quick answers to your burning questions? Check out the following commonly asked questions about house surveys.

It can take anywhere between three and 10 working days to get your house survey report back, depending on the type.

A house survey will cost between £400 and £1,500, depending on the property you’re buying and the level of detail the survey goes into.

Your solicitor and/or mortgage broker should be able to advise you on any issues that come up in your survey report. They may be able to translate the findings into more easy-to-understand terms to help you digest the information.

Significant issues can affect the property value and your ability to get the mortgage you need. Your broker or another independent financial advisor can speak to you about negotiating on price if needs be. Another option is to see if the seller would be willing to fix any of the major issues that are going to cost you money to resolve.

Yes, you may want to negotiate the house price based on the information you learn from your survey report. This is something your mortgage broker can advise you on.

Small issues like mould or peeling paint are to be expected with older homes. However, if your report discovers any big issues, such as windows that need replacing or gas fires that are unsafe (faulty gas fires can lead to carbon monoxide leaks), the necessary repairs could cost you a substantial sum.

In light of the money you’ll need to spend getting the property back to a liveable condition, you may want to consider speaking to the sellers about reducing the house price or asking them to carry out the repairs themselves.

A traditional house survey isn’t necessary for a new build property if you’re the first buyer. However, professional snagging surveys are highly recommended for new homes as they can spot any construction, fitting or decorating issues.

This should be done as soon as possible, but it will understandably depend on the time frame of your new home’s construction. If your home is finished before you exchange contracts (the point where you are legally committed to buying the property), this is an ideal time to have your snagging survey done, or before your completion date.

If neither of these options are feasible, get your snagging survey done as soon as possible after getting the keys (ideally within seven days).

If you’re the second buyer of a new build home (even if it’s only a few years old), a snagging survey won't be the right option for you. It would be sensible to have a traditional survey carried out instead.

You don’t need to attend the house survey, although you may be able to attend if you want to. You’ll need to speak to the surveyor and the estate agent to confirm that the surveyor and the seller are happy for you to attend.

Having a house survey carried out isn’t a legal requirement but it is a good idea as it’ll mean you’re clued up on the property you’re buying. Your lender might also require you to have a house survey done before agreeing to lend you money for your mortgage.

If you don't get a survey, you'll deny yourself from accessing a wealth of useful information about the property you're buying.

Yes, where possible, your survey report will include information about the property’s energy performance.

This isn’t carried out as part of the survey, but the surveyor will obtain the most recent Energy Performance Certificate (EPC) made available.

We have a complete beginner’s guide to mortgages, where we explain how mortgages work, how to work out your affordability, and what steps you need to take.

Surveying your options… get started today

So now you've got a clearer idea of how house surveys work, why they’re important and how to organise one for the property you’re buying.

There are lots of things that contribute to the costs of buying a property and moving home, so having a clear idea of what your survey will cost is vital for your budgeting plan.

Most prospective buyers are likely to be looking at Level 1 or Level 2 RICS surveys, which means you’ll probably spend between £300 and £1,000, depending on the size of the property.

Investing in a property survey is essential for not only your peace of mind but also your future financial security. It’s vital that you choose the right survey type for the property you’re buying, which might mean speaking to an independent financial advisor to help you decide.

Have you had a house survey done on a property in recent years? Did you discover anything unexpected?

How long will it take to get my house survey back?

How long will it take to get my house survey back? Get £15 cashback for joining TopCashback

Get £15 cashback for joining TopCashback