The information contained within this article is for editorial purposes only and is a general guide and description of the products listed. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.

With results day fast approaching, setting up a student bank account will be on many uni students’ to-do lists.

Of course, a UK student account isn’t a requirement for going to university, but the 0% overdraft and other perks will be sure to come in handy for most people embarking on this new chapter.

We’re here to help you decide what the best student bank account is for you so you can prepare for student life. We'll be discussing:

- How student bank accounts work

- What to look out for in a student bank account

- The most generous student bank account incentives available for September 2024

What is a student account?

Student bank accounts are designed for UK students about to start a university course.

They differ from a normal bank account as they have an interest-free arranged overdraft, meaning you can borrow money while studying that won’t cost you a penny in interest.

Who is eligible for a student bank account?

You can apply for a student bank account if:

You are 17+

You’ve been living in the UK for the past three years

You're a full-time undergraduate student, a full-time postgraduate or nursing student

You started your university course less than six months ago or are yet to start

International students have a different eligibility criteria and should check with the bank for specific requirements on bank accounts. Several banks have specific accounts to cater to international students' needs.

What to look for in a student account

It’s really easy to get sucked in by the freebies that certain banks offer when you set up an account with them. Although these freebies are obviously worth considering, there are several things you ought to think about when deciding on which bank to go with:

1. Size of the arranged overdraft

A student overdraft is interest free which basically means you have a free bank loan for your university years (and usually a few years after you graduate too) to give you some extra money.

Some accounts offer larger overdrafts than others, so you shouldn't rush this decision. Going over your set overdraft limit will not be interest-free and could mean you rack up an expensive bill.

You should always do your research on bank accounts and should never be borrowing money that you can’t afford to pay back.

2. Whether the overdraft size is ‘guaranteed’ or ‘up to’

Just because the bank offers an ‘up to £3,250’ overdraft, it doesn’t mean this is guaranteed.

Often, the higher amounts of money are only available in your third year, or sometimes even after your third year, which won’t benefit you if your course is only three years long.

The size of the overdraft you’re approved for will depend on your credit score too. Bear this in mind as if your credit score is low, your overdraft amount may be refused or not increase year-on-year.

To keep your overdraft, some banks require you to pay a minimum of £500 per term into your account (which can be your student/maintenance loan). This includes Santander, Nationwide, and many others. Every student bank account will need you to stay within your overdraft limit.

Be sure to check how much overdraft you’re guaranteed each year of your study. We’ll be laying this all out for each bank in the next section.

3. Freebie offers

Some banks offer great incentives for setting up a student bank with them such as free Railcards and Tastecards.

But don’t let a freebie suck you in if you won’t use it and end up missing out on other incentives.

If you plan on doing regular train commutes and would benefit from a Railcard, or enjoy eating out at specific restaurants valid with the Tastecard, then definitely consider the banks with these perks.

However, there are lots of other important factors to consider when deciding on a bank account. Things like the bank’s customer service and ease of use are more important than time-restricted incentives.

4. Location of your nearest branch

You never know when you might come into bank account trouble, so having a branch near to your university can be really handy.

Factor this in when deciding on your student bank account as you don’t want to find there isn’t a branch in your university town or city.

5. The bank’s customer service and satisfaction

To make sure you’re going to be looked after by the bank, research customer satisfaction statistics. You'll want to know that if you encounter any issues, your bank will give you the help you need.

6. Is it worth staying with your current bank for ease?

A lot of the banks offer the same or similar student bank account offers.

Be sure to check the student account vavailable with your current bank before deciding to move elsewhere as it will save time.

I had a lot of friends who set up a student account with the bank they were already with. This was because they had a good experience with the bank and were used to the banking app.

The banks were also running perks (£100 bonuses) for setting up a new account with them.

Student banking accounts don't offer these incentives, so familiarity with your existing bank may be the deciding factor when it comes to picking your student account.

However, setting up a student bank account with a new bank isn’t too time-consuming so don’t settle for less purely based on being loyal to your current bank.

It’s important to pick the student account that will benefit you the most while you study.

7. Repayment conditions

Banks will automatically turn your student account into a graduate account once you’ve finished your university course.

You will then have two to three years after you graduate to pay your overdraft back.

Be sure to check how long you have to pay your overdraft back. The longer you have, the more it’ll help you when you’re trying to gain financial stability post-university.

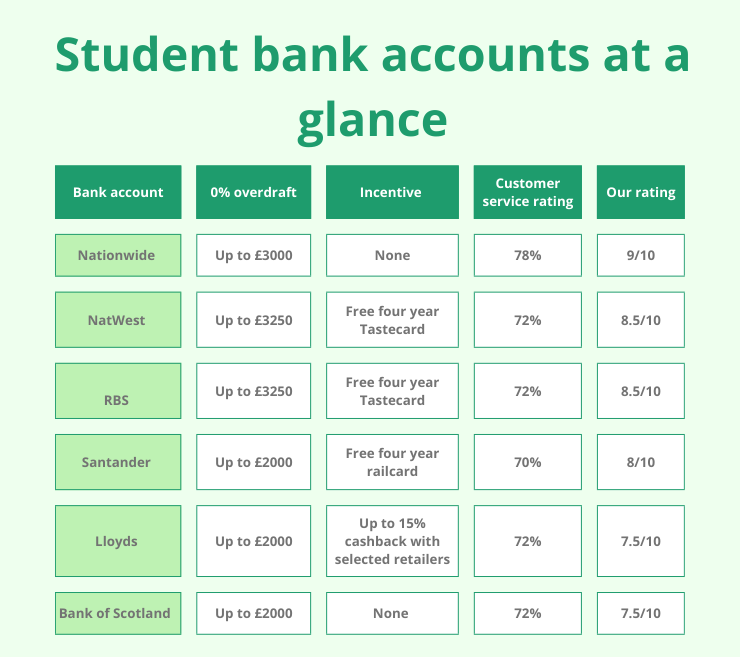

Our ranking of the best student bank account incentives for September 2024

Now you know what a student bank account is and what to look for, it’s time to see what student accounts are available after September 2024.

We’ve ranked all available UK student bank accounts based on their overdraft size, customer ratings and incentives.

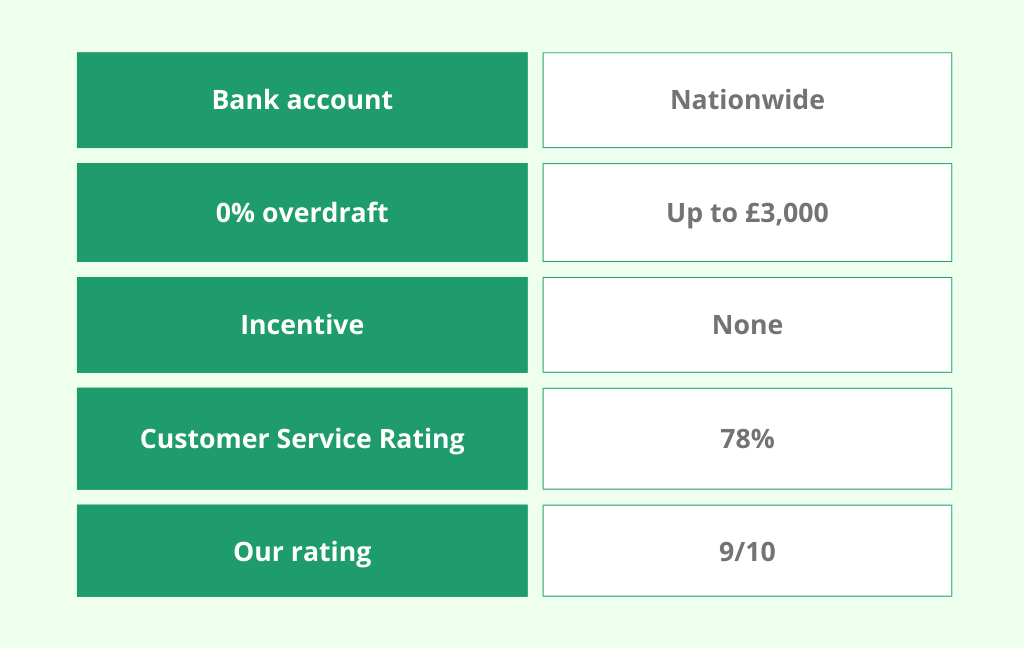

Nationwide

Nationwide have become a popular bank for student accounts due to their large overdraft size.

0% overdraft:

- Up to £1,000 in year one (based on a credit check)

- Up to £2,000 in year two (based on a credit check)

- Up to £3,000 in year three (based on a credit check)

After doing some research, we found that their maximum overdraft is more often granted than any other bank.

This means it’s very likely you’ll be able to get the full £3,000 by your third year, which is far more than most other banks are offering.

Incentive:

Nationwide used to offer a £100 cash bonus for signing up, but that stopped in June 2024.

Although Nationwide no longer offer a freebie, their large overdraft (if you are approved) continues to make it a great student bank account choice.

Branches:

Nationwide have 605 branches across the UK, making it the bank with the most branches.

We’re sure there’ll be a branch close by but it’s always good to check. Discover your closest Nationwide branch.

Pros:

- Nationwide have a large overdraft if you are approved which is a great perk.

- There are lots of branches, meaning you’re likely to find a branch not too far away from your university address and your home address.

- The app is really easy to use and their customer service score is the highest of any bank.

Cons:

- Nationwide loses 0.5 of a star due to there being no incentive for joining since they got rid of their £100 cash bonus last year.

- Nationwide loses another 0.5 of a star due to the need for their card reader for paying someone new. Having to use a card reader means it’s not as easy to bank transfer friends for ubers or drinks.

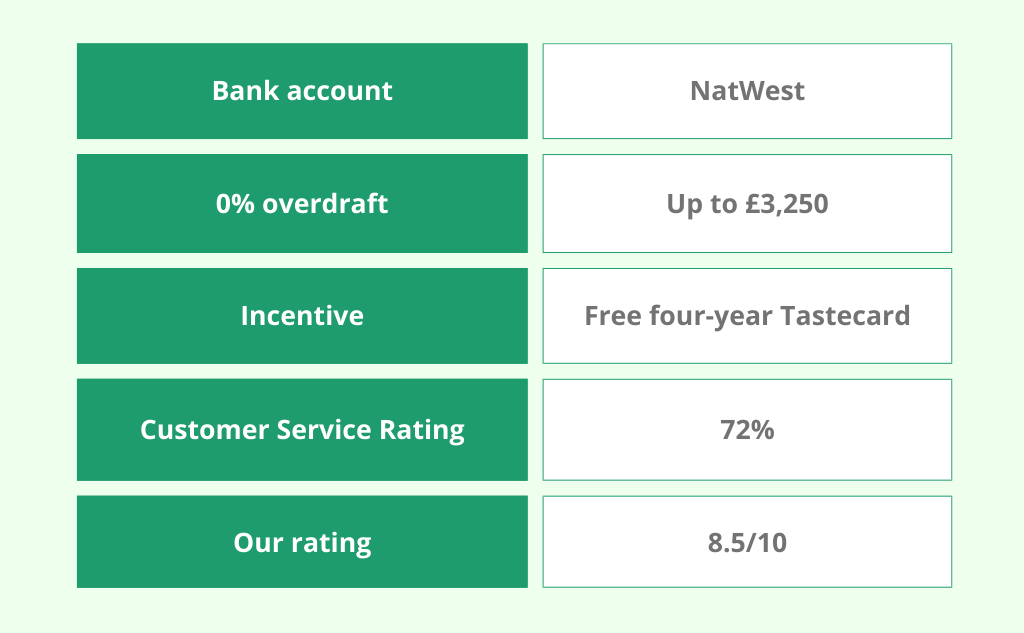

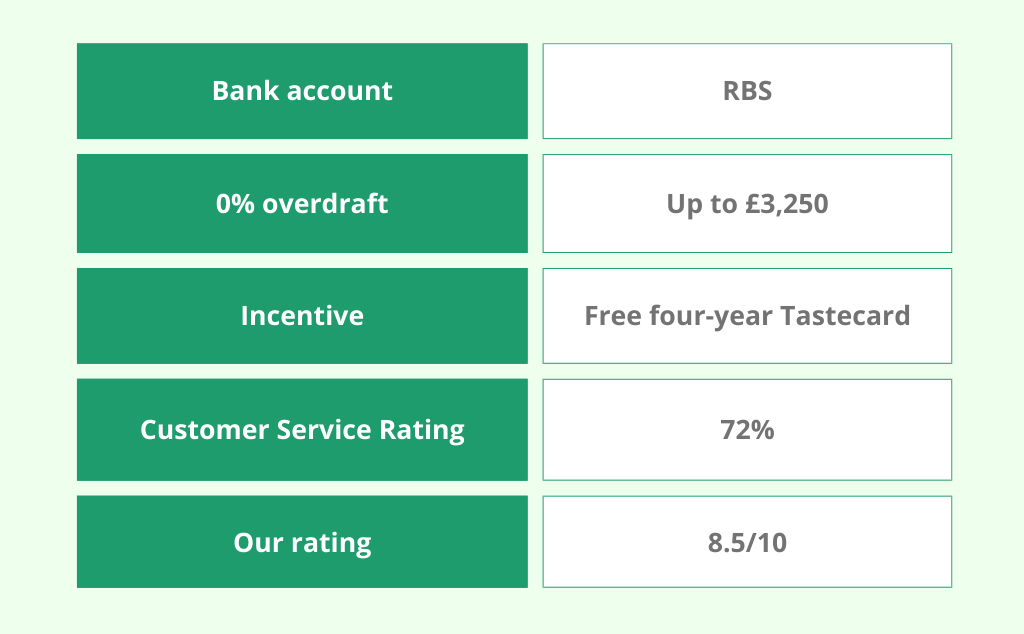

Natwest and RBS

Royal Bank of Scotland and Natwest are both part of the NatWest Group and have the same offer for their student accounts. Natwest is a popular choice due to the high number of branches spread across the country as well the large overdraft size.

0% overdraft:

- A guaranteed £500 overdraft for term one of your first year

- Able to increase your overdraft to up to £2,000 from the second term (based on a credit check)

- Able to increase your overdraft to up to £3,250 from year three onwards (based on a credit check)

Incentive:

A free four-year Tastecard that gives you access to two-for-one meals at selected restaurants as well as a 25% discount on your bill at other selected eateries.

The Tastecard website reckons you could save as much as £1,210 in a year with your discounts.

Branches:

- Natwest have 485 banks meaning the likelihood of having a branch close to you whilst at university and at home is likely. Discover you local Natwest branch.

- RBS have 43 branches, but most are in Scotland, so it’s worth checking to see if there is an RBS branch near you if you go to university in a different part of the UK.

The Natwest group have announced at least 100 bank closures. Be sure to check if the local Natwest branch to your university city will be affected by the closures.

Pros:

- As long as you’ve got a good credit score, you could receive the largest overdraft of any bank.

- £500 overdraft is guaranteed.

- The Tastecard is great for those wanting to eat out on a budget.

- Lots of branches so you’re likely to find one close by.

Con:

- The £3,250 maximum overdraft isn’t guaranteed and is credit score dependent. You may find you get less overdraft than a different bank if your credit score is low as only £500 is guaranteed.

Pros:

- RBS have the same great perks as Natwest in regard to the overdraft size, a guaranteed £500 overdraft and the Tastecard incentive.

Con:

- Their negatives are the same as listed for NatWest.

- Most of their branches are in Scotland.

Pros:

- RBS have the same great perks as Natwest in regard to the overdraft size, a guaranteed £500 overdraft and the Tastecard incentive.

Con:

- Their negatives are the same as listed for NatWest.

- Most of their branches are in Scotland.

Pros:

- As long as you’ve got a good credit score, you could receive the largest overdraft of any bank.

- £500 overdraft is guaranteed.

- The Tastecard is great for those wanting to eat out on a budget.

- Lots of branches so you’re likely to find one close by.

Con:

- The £3,250 maximum overdraft isn’t guaranteed and is credit score dependent. You may find you get less overdraft than a different bank if your credit score is low as only £500 is guaranteed.

Pros:

- RBS have the same great perks as Natwest in regard to the overdraft size, a guaranteed £500 overdraft and the Tastecard incentive.

Con:

- Their negatives are the same as listed for NatWest.

- Most of their branches are in Scotland.

Pros:

- As long as you’ve got a good credit score, you could receive the largest overdraft of any bank.

- £500 overdraft is guaranteed.

- The Tastecard is great for those wanting to eat out on a budget.

- Lots of branches so you’re likely to find one close by.

Con:

- The £3,250 maximum overdraft isn’t guaranteed and is credit score dependent. You may find you get less overdraft than a different bank if your credit score is low as only £500 is guaranteed.

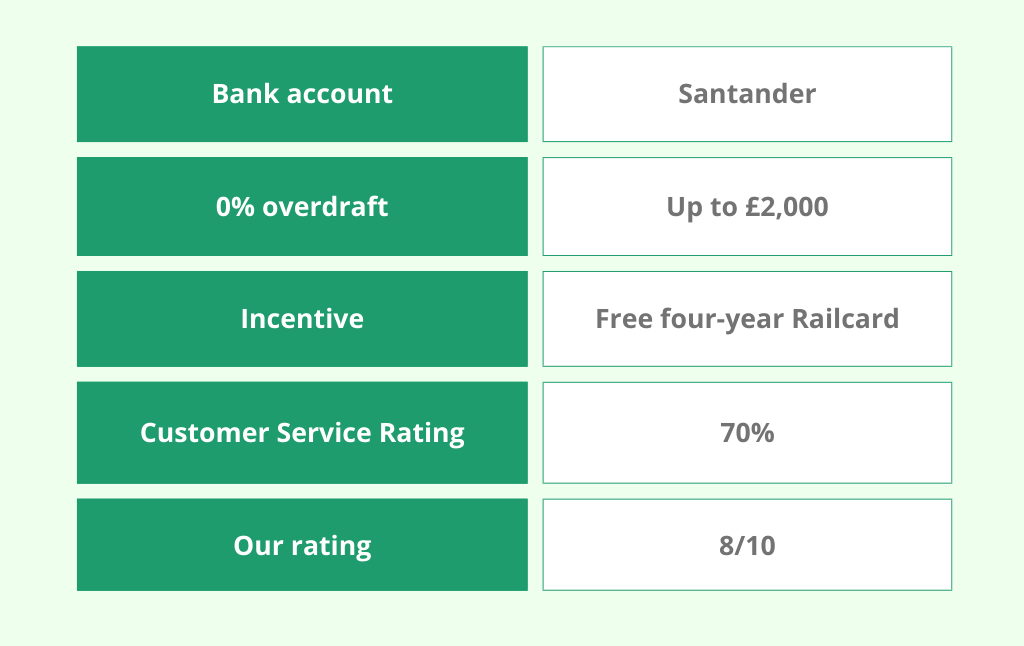

Santander Edge Student Current Account

0% overdraft:

- £1,500 in years one, two and three

- £1,800 in year four

- £2,000 in year five

Incentive:

Free four-year 16-25 Railcard with a value of £100. This gives you a third off most rail travel in Great Britain.

Branches:

There are 443 Santander branches across all of the UK. Be sure to check if there is a Santander branch close by to you.

When I went to university four years ago, I chose to go with Santander due to the Railcard.

I saved hundreds of pounds on train fares with the Railcard which was a massive help while trying to stick to a student budget.

I have found Santander really reliable and the online or mobile banking is so easy to use.

I got £2,000 overdraft which has now been reduced to £1,500. This would maybe make me reconsider setting up an account with them if I were starting university in 2024 as many other banks offer larger overdrafts.

Pros:

- £1,500 overdraft is guaranteed as long as you register for online banking and pay £500 in your account every five months. This is the highest guaranteed overdraft of all the banks.

- The four-year Railcard will save you £100 and will be so useful if you plan on doing regular/semi-regular train journeys.

Cons:

- Although the £1,500 overdraft is guaranteed, you could get a bigger overdraft with another bank as long as you have a good credit rating.

- The increased overdrafts are in years four and five which doesn’t benefit the majority of students (who only do a three-year course).

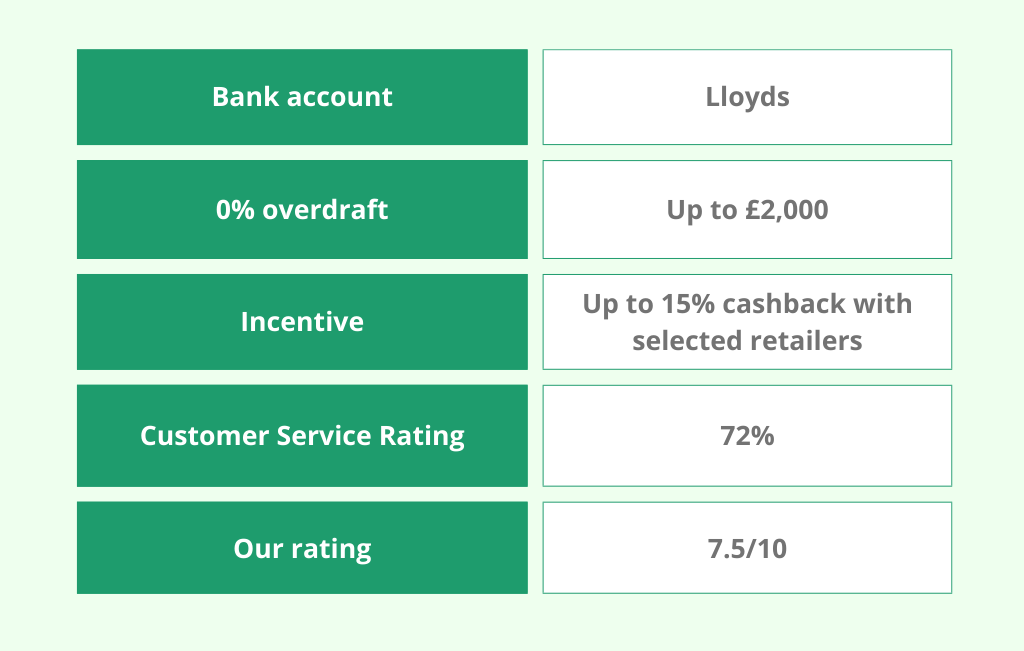

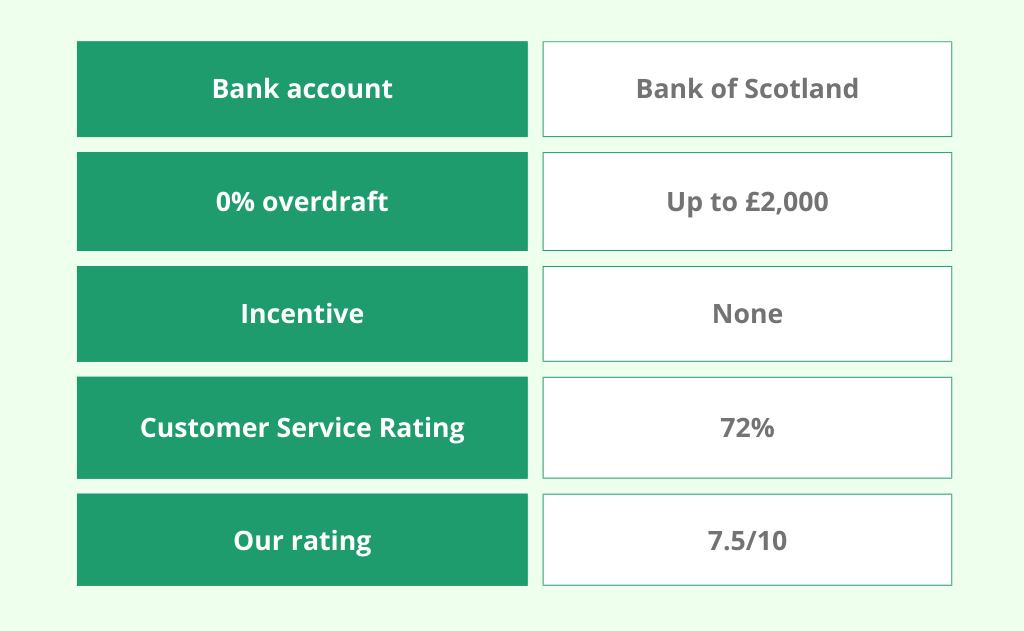

Lloyds Student Account and Bank of Scotland Student Account

Lloyds and the Bank of Scotland are both part of the Lloyds Banking Group plc and have the same student bank account offer. It will depend on where your university is based as to which bank would benefit you more.

0% overdraft:

- £500 in your first six months of opening your account (based on a credit check)

- £1,000 in months seven to nine of opening your account (based on a credit check)

- Up to £1,500 in months nine to 12 and years two and three (based on a credit check)

- Up to £2,000 in years four, five and six (based on a credit check)

Based on what we’ve read, it’s likely that most students will receive the full £1,500 after their first year.

Incentive:

Up to 15% cashback on things like shopping, gadgets, clothes and more with selected retailers.

Branches:

Lloyds Bank: 346 branches across England and Wales meaning it is a better choice than Bank of Scotland if you aren’t going to university in Scotland.

Bank of Scotland: 161 branches across Scotland. This means they aren’t the best choice if you want to be close to a branch and are studying in Scotland.

Pros:

- Most students receive the full £1,500 overdraft by the end of their first year (dependent on credit check).

- Up to 15% cashback at selected retailers could save you money.

Con:

- Their interest-free overdraft is lower than a lot of other banks. £2,000 is only offered to students in their fourth year, which many students don’t do.

Pro:

- The pros are the same as the Lloyds student account.

Cons:

- The cons are the same as the Lloyds student account

- There aren't any branches in England, Wales and Northern Ireland.

Pros:

- Most students receive the full £1,500 overdraft by the end of their first year (dependent on a credit check).

- Up to 15% cashback at selected retailers could save you money.

Con:

- Their interest-free overdraft is lower than a lot of other banks. £2,000 is only offered to students in their fourth year, which many students don’t do.

Pro:

- The pros are the same as the Lloyds student account.

Cons:

- The cons are the same as the Lloyds student account.

- There aren't any branches in England, Wales and Northern Ireland.

Pros:

- Most students receive the full £1,500 overdraft by the end of their first year (dependent on credit check).

- Up to 15% cashback at selected retailers could save you money.

Con:

- Their interest-free overdraft is lower than a lot of other banks. £2,000 is only offered to students in their fourth year, which many students don’t do.

Pro:

- The pros are the same as the Lloyds student account.

Cons:

- The cons are the same as the Lloyds student account

- There aren't any branches in England, Wales and Northern Ireland.

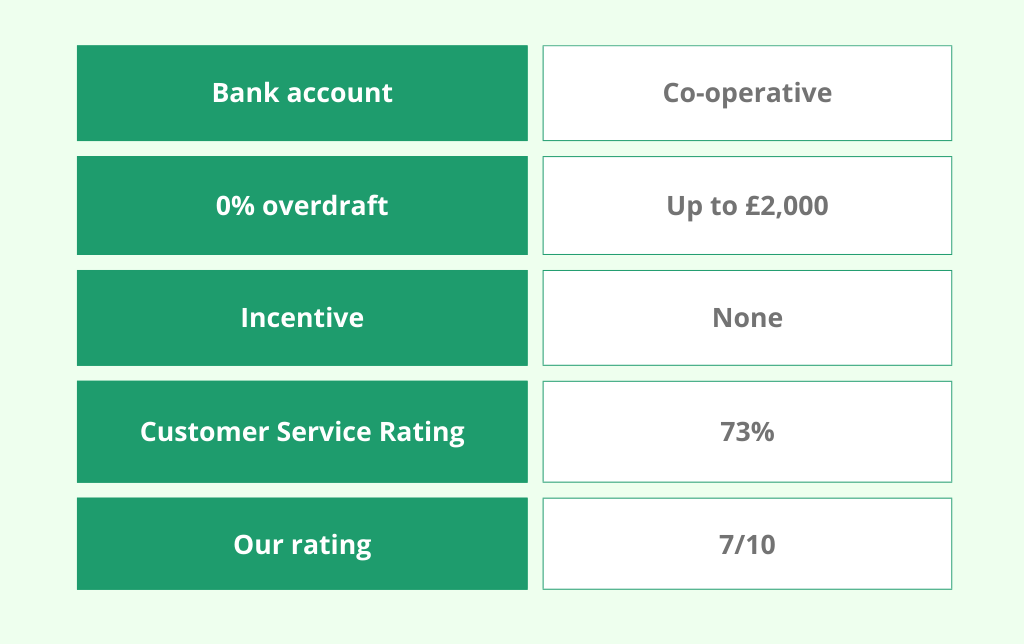

Co-operative Student Account

0% overdraft:

- £1,400 in your first year guaranteed

- Up to £1,700 in your second year

- Up to £2,000 in your third year and any further years of study

Incentive:

The Co-op don’t run an incentive for their student account.

Branches:

The Co-op bank have 50 branches, none of which are in Scotland and Wales. There are far fewer Co-op branches than any other bank we’ve discussed. Be sure to check if you’re close to a Co-op branch before setting up an account.

Pro:

£1,400 overdraft guaranteed.

Cons:

- A low number of branches means you may not have a branch local to you.

- They don’t run an incentive.

- There are no branches in Scotland or Wales.

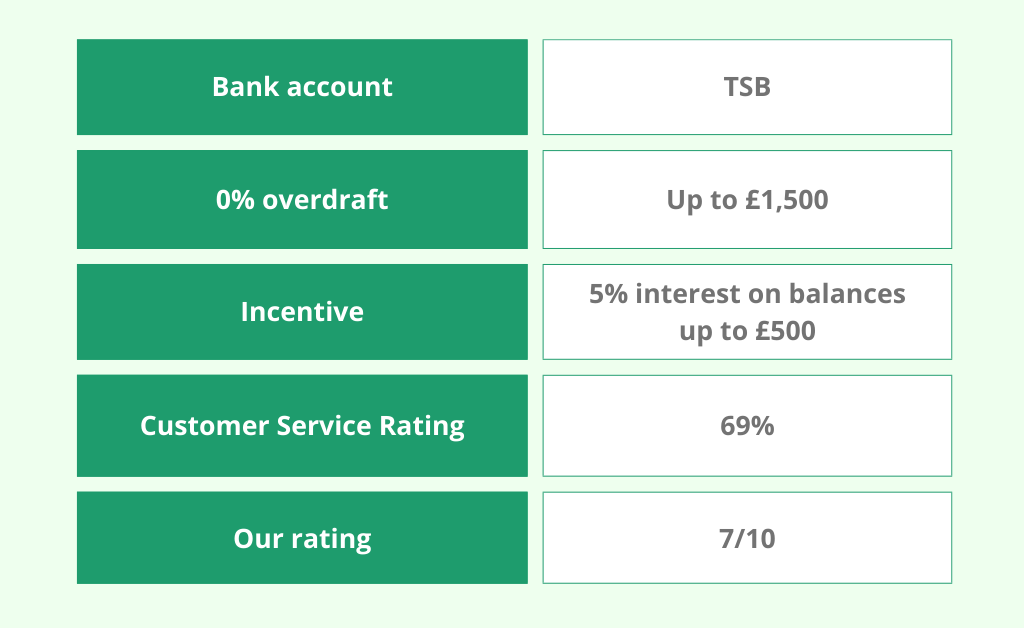

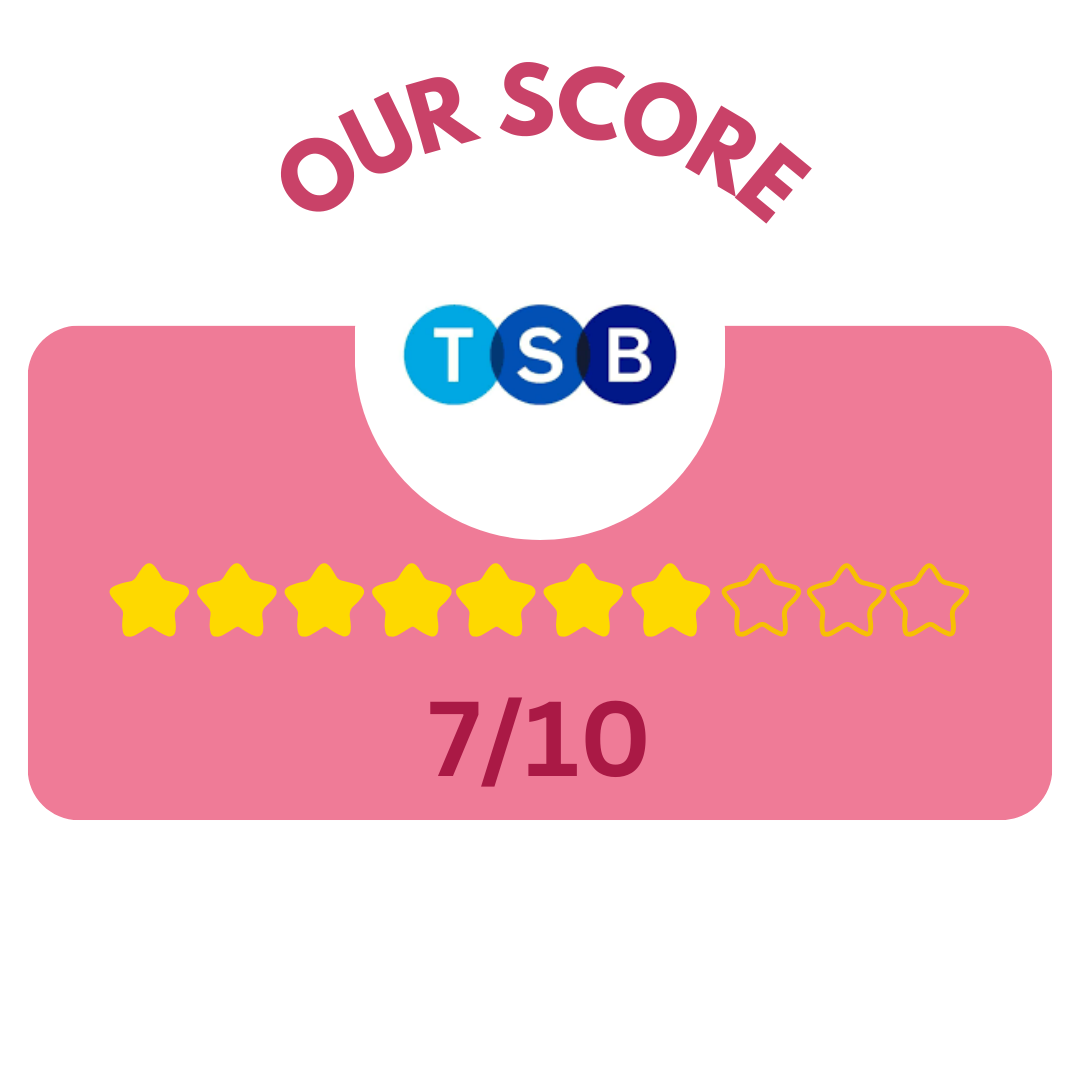

TSB Student Account

0% overdraft:

- Guaranteed £500 overdraft in your first six months of studying

- £1,000 overdraft in months seven to nine

- Up to £1500 after your ninth month

- As long as you have a good credit score, TSB are likely to give you the full £1,500 overdraft

Incentive:

5% interest on balances up to £500 which gives you a maximum of £25 a year in interest.

Branches:

211 branches across England and Scotland but there are no branches in Wales and Northern Ireland. Discover your local TSB branch.

Pros:

- Guaranteed £500 overdraft.

- 5% interest earned on account which can earn you up to £25 a year. Most banks don’t offer interest on student accounts so this is a great perk.

Cons:

- They have the joint lowest maximum overdraft amount which isn’t guaranteed.

- There are no branches in Northern Ireland or Wales.

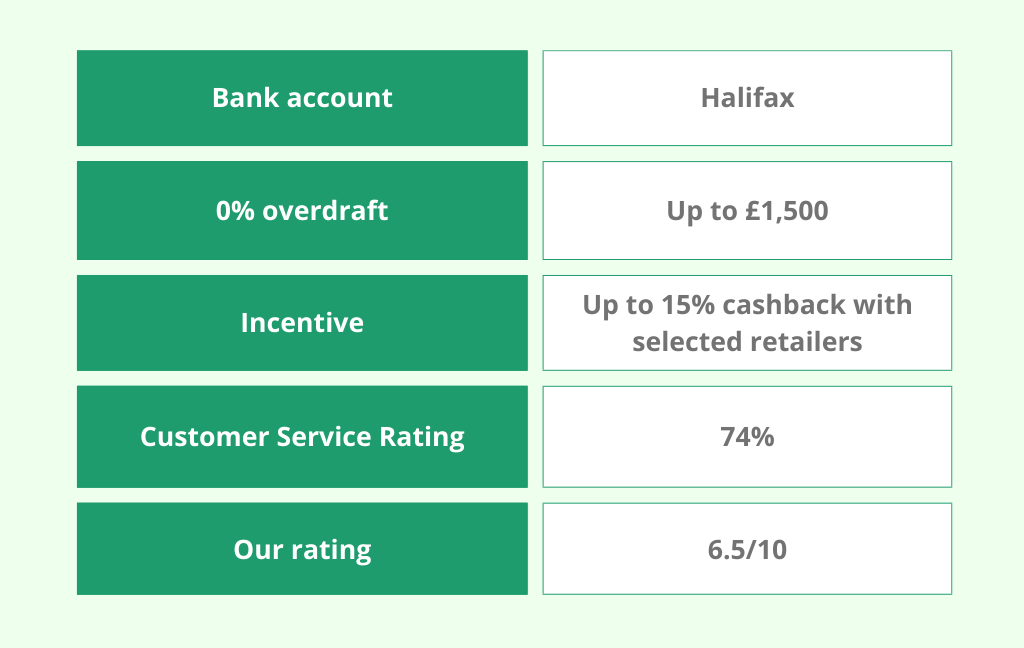

Halifax Student Current Account

Halifax Bank is also part of Lloyds Banking Group but offers a slightly different student account than Lloyds and Bank of Scotland offer.

0% overdraft:

- Up to £1500 interest-free overdraft for the length of your course plus three years after graduating

Incentives:

Up to 15% cashback with selected retailers with Cashback Extras, and a monthly interest payment of 0.10% EAR on any credit balance.

Branches:

476 branches across England, Wales and Northern Ireland, but Scotland only have Bank of Scotland branches. You can see where your nearest Halifax branch is on their website.

Pros:

- You have an overdraft for three years after graduating.

- Up to 15% cashback at selected retailers could save you a lot of money if you’re partial to some retail therapy.

- Lots of bank branches across England, Wales and Northern Ireland.

Cons:

- No guaranteed overdraft.

- They have the joint lowest maximum overdraft amount.

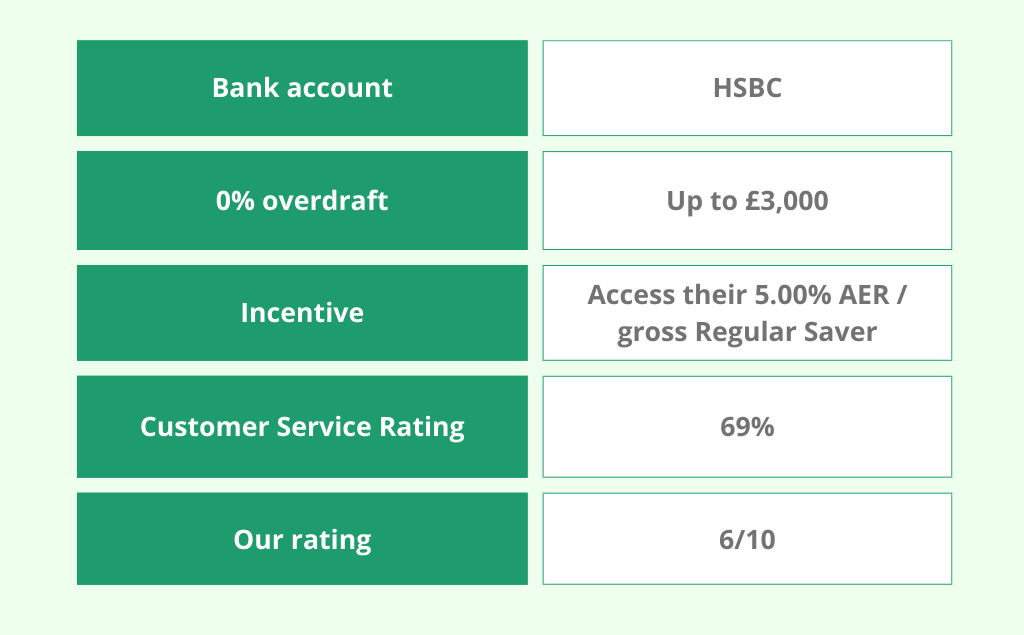

HSBC Student Bank Account

0% overdraft:

- Up to £1,000 in year one (based on a credit check)

- Up to £2,000 in year two (based on a credit check)

- Up to £3,000 in year three (based on a credit check)

Incentive:

Like Nationwide, HSBC used to give a £100 cash bonus for signing up, but that’s no longer the case.

The only incentive they offer is their 5.00% AER / gross Regular Saver. This allows you to save between £25 to £250 a month for 12 months, so you could earn up to £81.25 interest.

Branches:

HSBC have 333 branches throughout England and Wales.

This bank may not be a good option if you’re planning on going to a Scottish university as there won’t be a local branch. You can find out if you have a local HSBC branch online.

Pros:

- A chance to get up to £3,000 interest-free overdraft which is one of the higher overdraft allowances.

- Your account can earn 5% interest with their Regular Saver account.

Cons:

- HSBC have the joint lowest customer service rating.

- There is no guarantee you’ll get any overdraft if you have a low credit score.

- The 5% interest incentive has withdrawal restrictions. Many university students will struggle to save during their student years so may find this perk useless.

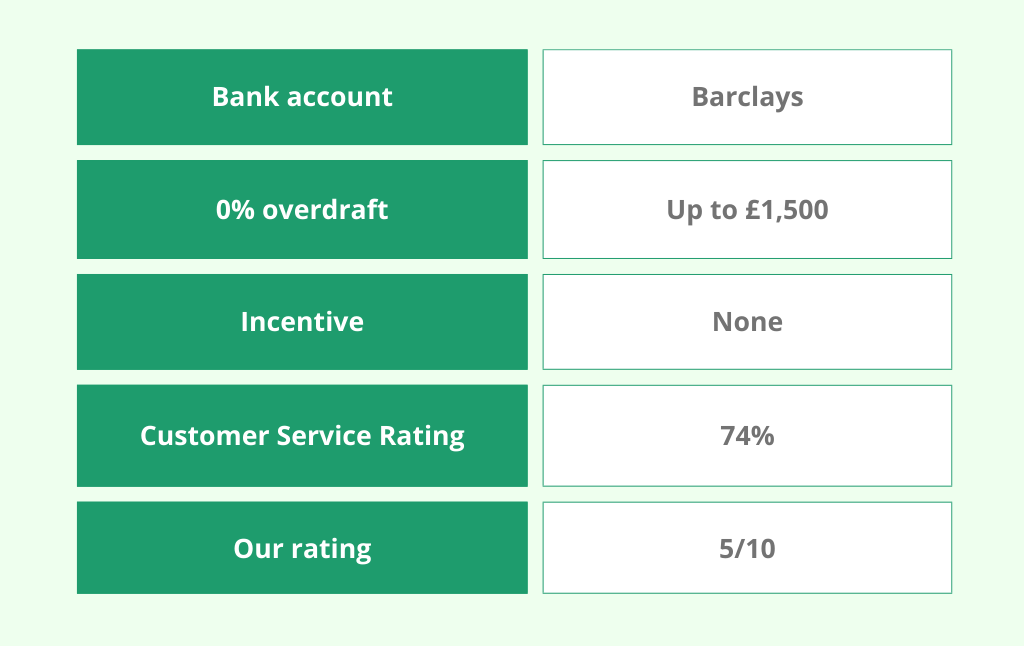

Barclays Student Additions Account

0% overdraft:

- Up to £500 in your first semester

- Up to £1,000 in your first year

- Up to £1,500 from your second year onward

Incentive:

Barclays used to offer a free 12-month subscription to Perlego which was worth up to £653 and gave you access to library books, academic texts and tools.

However, they stopped this deal in December 2023 and no longer run an incentive.

Branches:

There are currently 346 branches across all of the UK. Check to see if there’s a Barclays branch near you.

Pros:

- There are branches across all of the UK.

Cons:

- They no longer run an incentive.

- No overdraft is guaranteed.

- They have the joint lowest maximum overdraft amount.

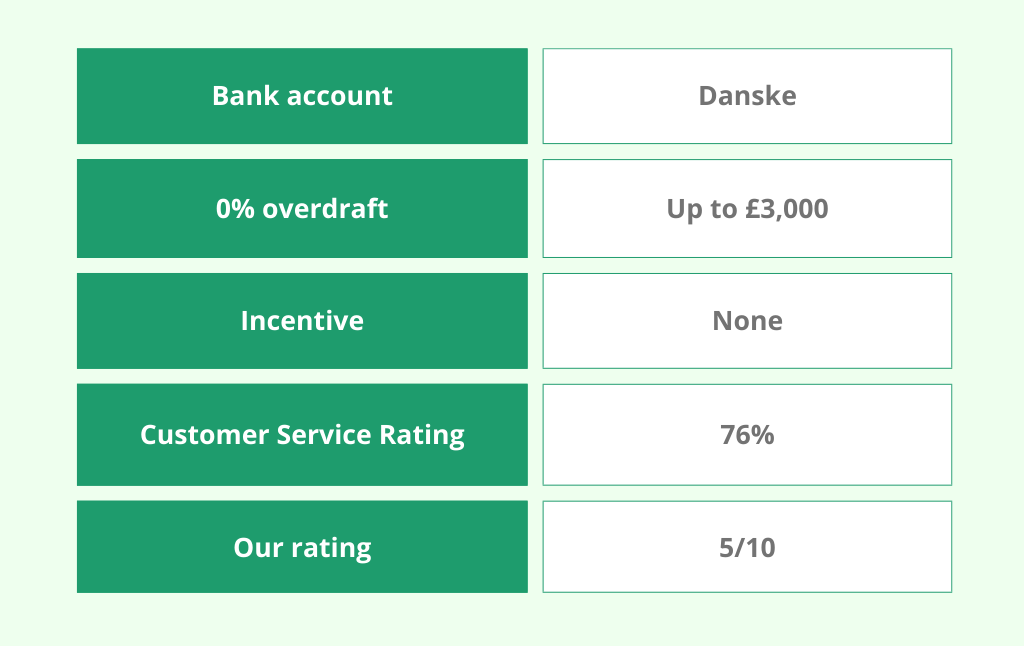

Student Bank incentives limited to Northern Ireland

The following banks only have branches in Northern Ireland. This means their student bank accounts are only an option if you plan on going to a Northern Irish university.

Danske Freedom Account

0% overdraft:

- Up to £3,000 overdraft

Incentive:

There is no incentive for setting up a Danske Freedom account.

Branches:

All 24 of their branches are in Northern Ireland, so you would only really use Danske bank if you were going to university there. Discover Danske's branches and see if one is nearby to you.

Pros:

- One of the higher overdraft allowances which you’re likely to get with a high credit score.

Cons:

- A low number of branches, with none in England, Scotland or Wales.

- No guaranteed overdraft.

- No incentive offered.

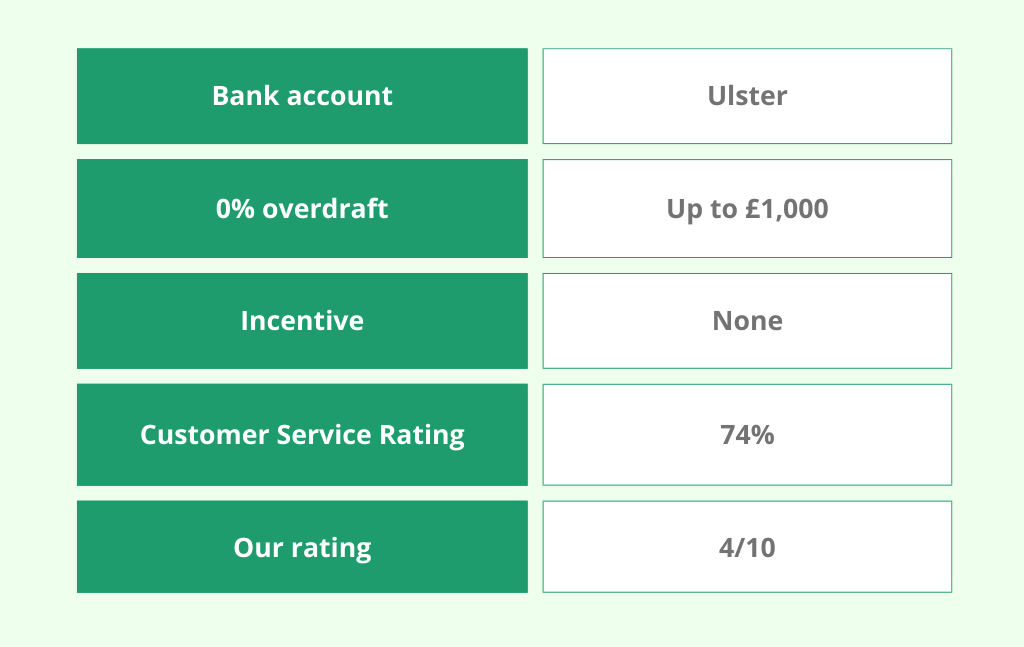

Ulster Bank Student Account

Ulster Bank is also part of the Natwest Group plc along with Natwest and RBS. They offer a different student bank account.

0% overdraft:

- Up to £1,000 overdraft (subject to credit review and approval).

- Up to £3,000 overdraft for students studying medicine, dentistry, law, accountancy, pharmacy, optometry, physiotherapy and veterinary science (subject to credit review and approval).

Incentive:

Ulster Bank don’t offer any incentives.

Branches:

Ulster Bank only have 14 branches in Northern Ireland and are planning to close one of their branches by November 2024.

Pros:

- High overdraft for those studying certain subjects.

Cons:

- No overdraft is guaranteed.

- Only 14 branches which is the lowest number of any bank discussed meaning there might not be a branch close to you.

- No branches in England, Scotland or Wales.

How do you open a student bank account?

Once you’ve decided which bank you want to set up your student account with, the application process is easy.

All of the student bank accounts we’ve discussed in this article have an online application process which will differ slightly depending on the bank.

Visit each bank's website if you need more information about setting up your account, or visit your local branch.

Student bank account FAQs

A student bank account is a current account aimed at higher education students. They tend to have a 0% interest overdraft and other incentives to benefit students.

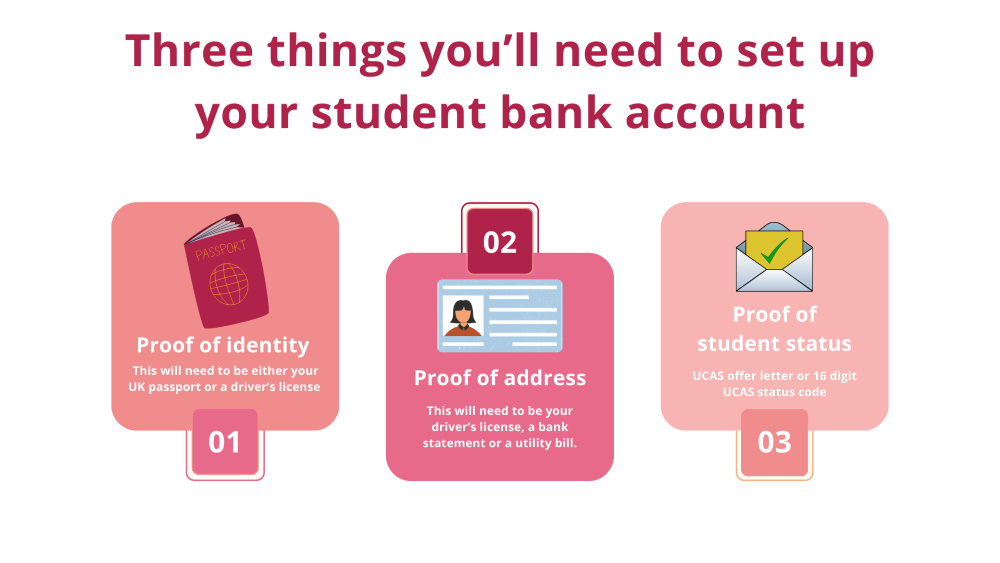

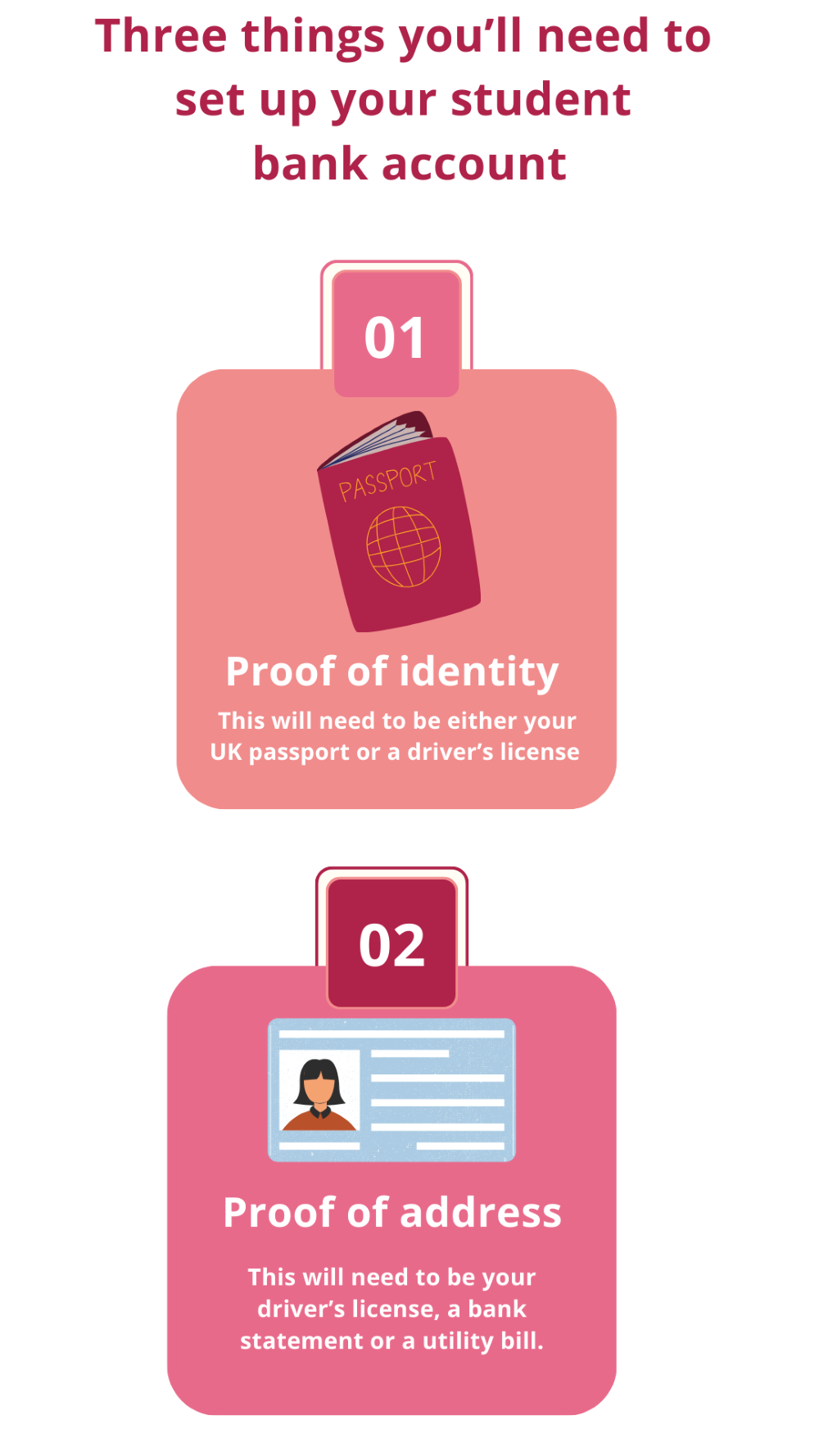

The process will vary between banks but all will need a proof of identity, proof of address and proof of student status. Check the bank’s website for the steps to set up a student bank account and apply online, or visit your local branch.

There isn’t a black and white answer to this question. It really depends on what you want from a student account and your geographical location.

Here are the student bank accounts that we think are the best for certain criteria. Of course, you should always do your own research before making a financial decision.

Pick overall: Nationwide

Pick for a large overdraft: Natwest or RBS, depending on your location

Pick to guarantee most amount of overdraft: Santander

Pick for perks: Santander

Pick for customer service: Nationwide

You have to have lived in the UK for at least three years to be eligible for a student bank account. Otherwise, you’ll be classed as an international student and cannot have a student bank account but will be able to have a regular bank account.

You should only have one student bank account, even if you have several current accounts and savings accounts. You’re expected to pay your student loan into your student account, meaning only one account is allowed.

Choose the best student bank account for you

Now we’ve given you an insight into what each student bank account has to offer, the decision is in your hands. If you’re still not sure, here’s our breakdown of the most generous student bank accounts based on some wants and needs.

The information contained within this article is for editorial purposes only and is a general guide and description of the products listed above. Nothing in this article should be relied on as financial advice.

There may be other products available not listed in this article which may be more suitable for your personal needs.

Have you had any experiences with one of the student bank accounts we’ve discussed? We’d love it if you shared your thoughts for readers starting university in September 2024.

Get £15 cashback for joining TopCashback

Get £15 cashback for joining TopCashback